ECB’s 2022 climate risk stress test sets banks to work

02/03/22

Five unprecedented challenges for banks

The new climate risk stress test of the European Central Bank (ECB) is the first of its kind for most banks. In a short period of time, banks will have a lot to deal with. PwC experts Abdellah M'Barki and Julien Linger outline the five key challenges of the ECB 2022 climate risk stress test.

Climate risk stress test

The ECB has launched its 2022 climate risk stress test to enhance the capacity of both banks and supervisors to assess climate risk and get more insights on data availability, limitations in assessing climate risk and best practices. Banks subject to this ECB exercise are accelerating their efforts to meet the ECB deadline in the first half of 2022.

One approach, three modules

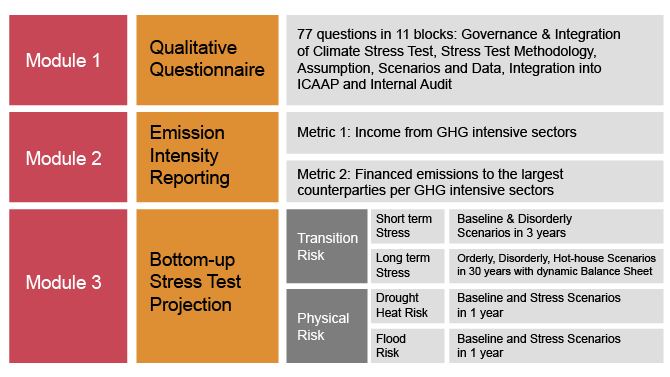

The 2022 ECB climate risk stress test exercise contains three modules. All significant institutions participating in the ECB 2022 climate risk stress test exercise are subject to module 1 and module 2. For module 3, the ECB identified a subset of participating banks.

Five main challenges

Supervisory authorities such as Banque de France, Bank of England and De Nederlandsche Bank have previously conducted climate risk stress tests. However, ECB’s 2022 climate risk stress test is more complex compared to previous supervisory exercises due to a more granular approach and the long projection horizon of thirty years. Conducting a bottom-up climate risk stress test is a different game in many aspects. In this blog we summarize the five main challenges that we observe:

1. The expectations maze

From the release of the methodological note to the advanced data collection deadline, this stress test is a four-month sprint amongst other efforts to meet various supervisory and regulatory expectations. Therefore, there is barely room to liaise with other (ESG) related projects within the bank and align on every interdependent aspect to ensure consistency. Examples of ongoing projects include implementing ECB’s expectations on the management of climate-related and environmental risks, reporting initiatives on ESG and stress test efforts for ICAAP (due date end of April 2022). Managing all these expectations and ensuring alignment with the climate risk stress test is a daunting task.

2. The strain of dimensionality

Dealing with climate risk requires a longer term approach. In line with this, the time horizon for transition risk is thirty years compared to the classic three years horizon in a ‘traditional’ stress test. Due to the long horizon of the climate scenarios, banks are required to project credit risk parameters upto three decades, and this presents a computational challenge to the existing models, especially those relying on migration matrices. Moreover, this stress test also requires reporting at 22 NACE sectors and eight EPC rating levels, which are more granular than the asset class levels required in previous stress test exercise. As a result, the current stress testing engines used by the banks are not readily equipped to process credit risk parameters at this high dimension.

3. The data conundrum

As the banks are still in process of integrating climate and environmental risk into their IT & data architecture, it is difficult to gather all the relevant and required data in time for this stress test exercise. At this stage, only a few companies report their carbon footprints, hence it is challenging for banks to report greenhouse gas emission for their top obligors per industrial sector, as required in this stress test. Furthermore, the quality of industrial classification and geospatial data gathered by banks will also be put to the test during this exercise.

4. Developing a long term strategic response

The dynamic balance sheet assumption accounts for banks’ reaction to the shock over thirty years. However, there is not yet a bank-wide carbon reduction strategy, and most of the portfolios do not have projections over three decades. Therefore, each business line or department needs to individually assess the impact of transition policies on their counterparties and determine its long term strategic response. Moreover, given the stickiness of beliefs on climate risk, it is difficult to gauge whether the market would respond in time to absorb the strategic shifts the banks envision for a low-carbon future.

5. The difficulty of interpretation and application

Current stress test models and approaches will simply not be fit for purpose, as climate risk is generally not captured in current models and approaches. The traditional financial modelling frameworks do not yet capture how climate risk interacts with the economy through different transmission channels. At best, climate risk is being incorporated into IFRS 9 provisions as an overlay. The lack of sector level benchmark made it especially challenging to judge the plausibility of model outcomes. While many departments of the banks are eager to incorporate climate risk in their decision pathways, the stacking of assumptions used in this exercise makes it difficult to apply the results directly to strategies.

Bravely moving forward to identify, measure and mitigate climate and environmental risks

ECB’s climate risk stress testing exercise will be the first of many. Over time, more climate data will become available and banks will gather more experience. We believe that the ECB 2022 climate risk stress test will serve as a stepping stone for banks to push their risk management transition towards identifying, measuring and mitigating climate-related and environmental risks. The experience obtained through this exercise and approaches developed should be broadly leveraged, particularly in the risk management and reporting functions, other internal stress tests (e.g. for ICAAP purposes) and scenario analyses.

Creating value and impact through ESG

To create value through ESG (environmental, social, and governance), you need to put the theory aside and develop a concrete and practical plan to get started. Being successful is not just about finance, disclosure, climate change or diversity. It is about embedding all of these - and other - principles in your strategy and activities. It is essential to embed ESG factors into your company's strategy and transformation, as well as into reporting and assurance to ensure a successful sustainable future.

Contact us