Bridging the gap from climate transition planning to implementation

Banks and insurance companies need to develop a holistic approach towards bridging the gap from climate transition planning to implementation.

Hydrogen (H2) is taking an increasingly important role in the energy transition, as it has the potential to replace fossil fuels and serve as a long duration storage solution for renewable electricity generation to help balance our electricity system.

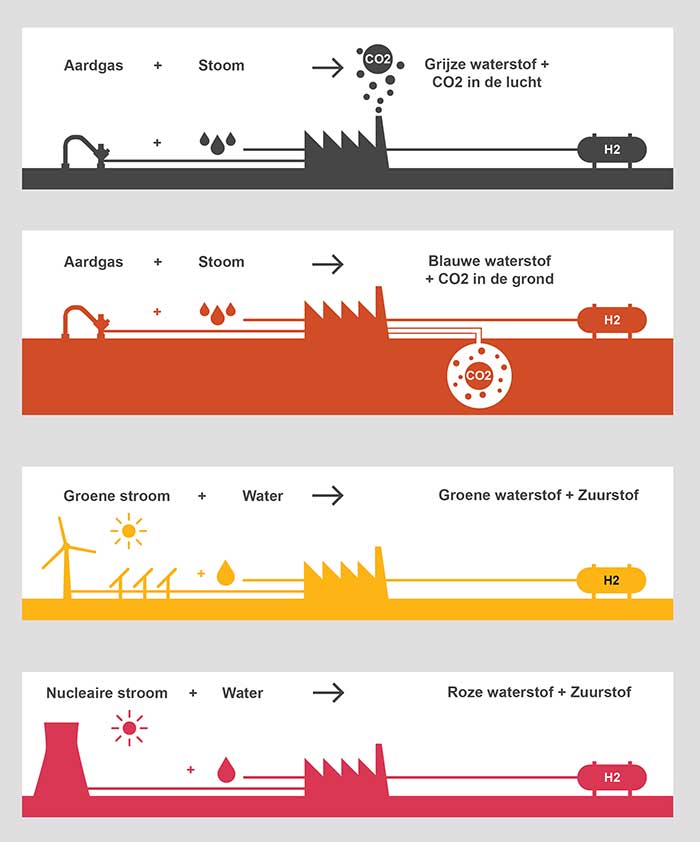

To date, nearly all hydrogen produced worldwide is grey, meaning it is produced (mainly) with natural gas. Capturing and storing the CO2 makes grey hydrogen blue. When the electricity needed for the production of hydrogen is from a renewable source, it becomes green hydrogen. Purple hydrogen is similarly produced, but the power is produced by a nuclear power plant.

The development of hydrogen technologies is accelerating due to advances in electrolysis and conversion and the decreasing cost of renewable energy. To achieve future market success, governments and companies are piloting and scaling up to gain experience. However, green hydrogen is currently significantly more expensive than grey hydrogen and business cases of many green hydrogen projects remain commercially unviable. Therefore, the biggest challenge is to identify green hydrogen applications that will generate sufficient return, both in the short and long run, and securing the offtake over a longer period of time. This requires companies to fully understand the market dynamics, value drivers and cost of the production process to identify key opportunities, as well as detailed alignment and contracting with stakeholders and government to ensure offtake. Moreover, companies face numerous challenges in obtaining financing, permitting, as well as managing and auditing the project. Navigating this complex world can be challenging. PwC can work with you, from strategy definition to business case development and execution.

PwC supports companies and governments in adopting hydrogen as a sustainable and economically viable energy source by sharing comprehensive and up to date insights into the technology and market dynamics as well as relevant business case expertise and related legal factors and tax implications.

Our services include:

PwC evaluated the production cost trajectory of green hydrogen worldwide, giving us a better understanding of early movers and potentially large suppliers across countries and regions. The key results of our analysis include the following:

To gain practical experience and capitalise on efficiencies through learning curves and scale effects on production, transport and conversion equipment final investment decisions are needed on e.g. joint pilot projects.

As both demand and supply of hydrogen need to scale-up, governments play a pivotal role in stimulating investments through subsidies and taxes but also by matching supply and demand and mitigating long-term uncertainty. To create this environment, a broad view of market developments and value drivers, specialised knowledge on technology, taxes and incentives and extensive experience with stakeholder management and contracting are required. PwC has the required expertise to help organisations and governments navigate through this complexity.

Banks and insurance companies need to develop a holistic approach towards bridging the gap from climate transition planning to implementation.

PwC research reveals the Netherlands' excellence in decarbonisation and economic growth, showcasing optimistic insights.

Discover how the new EU Omnibus package reshapes sustainability reporting. PwC expert Ellen McCready shares key insights on navigating these changes.

Experience shows that the materiality of biodiversity is often greater than expected. By following our recommendations, companies can effectively include biodiversity in their DMA process and ensure a good score in their reporting and strategy.

Partner - Assurance - Hydrogen Leader, PwC Netherlands

Tel: +31 (0)65 115 90 81

Menno Braakenburg

Director Strategy & Transformation, Energy & Utilities, PwC Netherlands

Tel: +31 (0)68 118 01 51

Mohammed Azouagh

Senior Manager - Tax, Sustainability and Incentives, PwC Netherlands

Tel: +31 (0)62 380 36 54

Maurice Koerse

Senior Manager - Valuations & Modelling - Energy Transition, PwC Netherlands

Tel: +31 (0)68 353 30 00

Stéphane Jager

Manager - Capital Projects & Infrastructure, PwC Netherlands

Tel: +31 (0)68 363 16 71