Creating significant value

Divesting companies that are no longer strategic fits can create significant value for organisations and their shareholders. According to PwC’s Divestiture Study, a comprehensive study of 2,500+ senior leaders related to corporate divestitures, we found that over the past decade, the median organisation that made a divestiture saw an increase in its market-adjusted stock price around the date of announcement, with the top quartile receiving a ten percent boost. Furthermore, we tracked the organisations that had a positive return at announcement over the next twelve months, and at the end of this period, their stock price outpaced industry peers.

Importance of speed to execution

Divestitures are complex undertakings. They are data-intensive projects, involve dynamic deal structures, require tight deadlines, and affect many different stakeholders. At the same time, deal speed is important at every step of a divestiture process. ‘Shortening the period of time from the decision to divest to closing the deal has been shown to increase the likelihood of a positive total shareholder return’, says Steven Zikeli. ‘For instance, according to PwC’s Divestiture Study, when the time between announcement and close was less than twelve months, the median seller had greater excess returns compared to its industry peers — and even greater returns when close was less than six months. But, when the time was more than twelve months, the median seller underperformed industry peers.’

Begin with the end in mind

In order to execute on the deal as quickly and efficiently as possible, organisations must consider both short-term and long-term needs with respect to carve-out data. ‘In the short-term, it may appear that a carve-out requires only corporate development input and focused financial information’, says Sharan Visser. ‘However in the long-term, divestitures affect all parts of the organisation. Investing time upfront to understand the data needs of various stakeholders (tax, accounting, financial planning and analysis, HR, audit, and information systems, etcetera) enables the creation of an aligned data strategy across workstreams. This often requires creating a centrally-managed data model, with source information directly extracted from financial systems, which ensures traceability throughout the project. Additionally, by ingesting as much relevant data as possible, it allows the model to remain flexible throughout the transaction as the deal perimeter changes and assets move in and out.’

Define the transaction perimeter and understand systems landscape

The first step in developing a robust data model during a carve-out is to clearly define the business which is being divested (DivestCo). This requires an understanding of the organisation from which the business is being divested (RemainCo) as well as the form of the transaction being contemplated (i.e., spin-off, stock sale, asset sale). ‘A full understanding of the current systems and processes of the business are essential to developing an effective data strategy’, states Zikeli. ‘Clearly defining the DivestCo business allows for the segmentation activities to be logically driven by data to the greatest extent possible.’

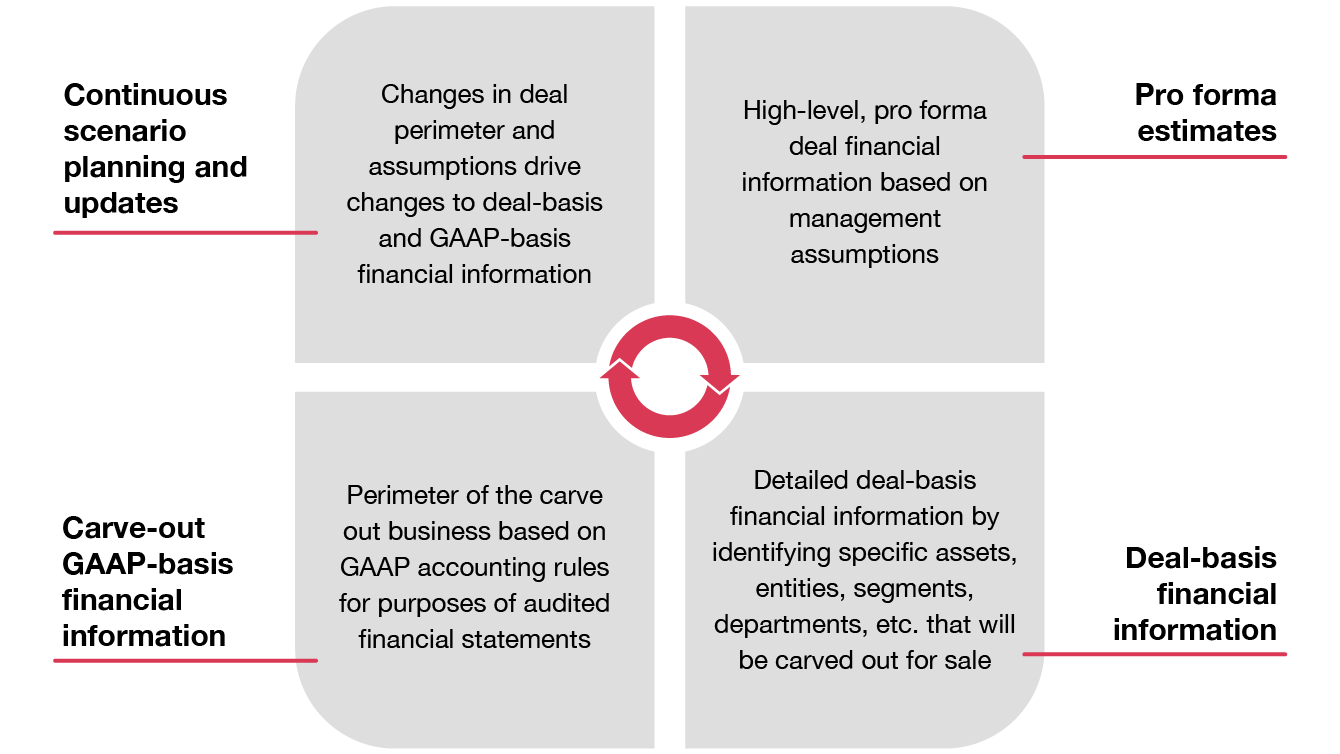

Organisations have several cross-functional needs for reporting on financial information of DivestCo.

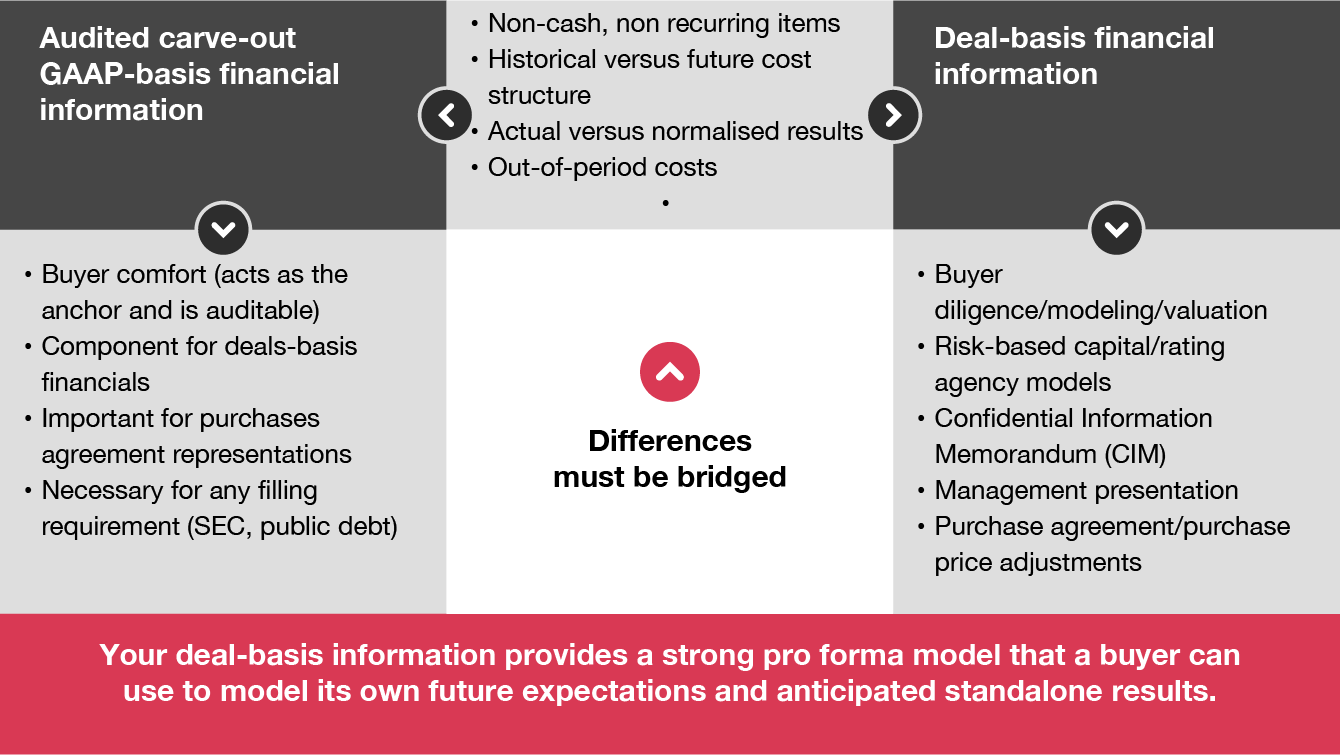

The carve-out data model will need to serve multiple purposes. Visser: ‘Initially, for diligence and corporate development purposes, pro forma financial information is generally developed using high-level management assumptions and estimates. Thereafter, a more detailed set of deal-basis financial information will need to be created for buyer diligence, confidential information memorandums, management presentations, and purchase agreements. This will require a ‘bottom up approach’ with historical transaction-level financial data across relevant departments, legal entities, segments, and assets planned in the deal.’

Finally, financial reporting requirements of the buyer or seller as well as financing requirements may necessitate audited GAAP-basis carve-out financial statements, which often has a different ‘accounting perimeter’ than the deal-basis financial information. ‘Therefore, having a ‘single source of truth’ driving each of these outputs, that is flexible to change with the deal perimeter across the deal lifecycle, is critical to driving a successful divestiture that maximises value’, Visser continues. ‘This also allows management to more easily understand and communicate differences between the outputs.’

Apply a structured approach to distinct DivestCo financials

Organisations often find that DivestCo and RemainCo are significantly more commingled than originally anticipated, especially as legal, regulatory, and tax impacts are considered and incorporated into the deal perimeter. To disentangle these for purposes of creating financial information, a data-driven approach is key.

Zikeli: ‘Decision trees based on system and business logic must be used to segment balances and transactions into DivestCo and RemainCo. In many cases, a ‘waterfall’ approach (i.e., chain of decision trees) should be used where different data elements are used in sequence to make a decision on the appropriate treatment of a balance. For example, the legal entity may be the first element used to segment financial balances, which may only address a small portion of the total balance.’

For legal entities that are not entirely DivestCo or RemainCo, a subsequent step may be required to segment using cost center, profit center, or another relevant data field.

This ‘waterfall’ approach can cycle through several different data elements in order to perform a data-driven segmentation. It is crucial to consider that the perimeter will change several times during the deal lifecycle, so this data-driven approach must be nimble in the face of uncertainty. This allows organisations to begin the divestiture process despite the fact that the buyer landscape and transaction structure is not final.

Handling commingled balances

Analysing commingled financial data for purposes of creating historical financial information for DivestCo is oftentimes the most labour-intensive and time-consuming activity in a carve-out process. Subject matter experts across various parts of the organisation must be engaged resulting in additional workload on top of ‘business-as-usual’ activities.

Different approaches are required for different functional areas or account balances. For example, in order to segment accounts receivable for purposes of historical financial information of DivestCo, it is necessary to analyse the AR sub-ledger. In some cases it may be possible to attribute all balances for a certain customer to a specific business, and other times it needs to be analysed at the invoice level for customers with business with both DivestCo and RemainCo.

‘It is not always possible to clearly assign balances to one business in which case the balance may need to be allocated between both businesses’, says Visser. ‘In this case a logical, supportable allocation driver must be identified and applied to the balance. These steps may need to be re-done each time the deal perimeter assumptions change. Therefore, a flexible data model is crucial to driving deal speed.’

Planning and executing a successful divestiture

Planning and executing a successful divestiture is more challenging than most organisations expect, and there is a risk of value leakage. ‘PwC has the experience and methodology in place to overcome these challenges and optimise value’, Zikeli determines. ‘Our deals experts use a tech-enabled framework to provide solutions to carve-out financial reporting, sell-side financial due diligence, tax structuring, operational / IT separation, and human capital strategies. Our proven proprietary technologies allow us to quickly create a carve-out data model that can be used across the deal lifecycle, from deal strategy through post-close optimisation.’

Newsletter

Sign up for PwC Update and stay informed.

Read the three previous articles in this series here:

Part 1: Transformational value creation through carve-outs

Part 2: Compelling and auditable carve-out financial statements

Part 3: People, regulation and tax are crucial in carve-outs