Transformational value creation through carve-outs

Unlocking greater value from divestitures

Companies evolve and portfolio management — which includes expansion, contraction and other reconfigurations — is critical to survive. Companies that proactively review their portfolio and consider and complete divestitures (carve-outs) via timely decision-making are more likely to create value, state PwC experts Maxime Stoopen and Steven Zikeli.

A well-planned, balanced growth portfolio

With economic pressures mounting, it is imperative for your company to have a well-planned, balanced growth portfolio. This helps to boost your performance in the short and medium term. You need to reassess your entire portfolio in a number of areas:

Value added versus investment required

Long-term strategy of business units, brands and product portfolio

Strategic fit

As a company you must challenge yourself in terms of structure and design - ‘end to end’ - and reinvent what work gets done, how and where. You need to identify parts of the business that may not have a strategic fit, and work to transform and confidently divest these businesses. This will allow your company to focus time and resources on the businesses that are the best fit in your portfolio.

According to PwC’s Divestiture Study, a comprehensive study of 2,500+ senior leaders related to corporate divestitures, we found that divestitures create significant value. Over the past decade, the median company that made a divestiture saw an increase in its market-adjusted stock price around the date of announcement, with the top quartile receiving a ten per cent boost. Furthermore, we tracked the companies that had a positive return at announcement over the next twelve months, and at the end of this period, their stock price outpaced industry peers.

A proactive portfolio review is essential - it drives a 2.5x increase in the chances of delivering a positive return to shareholders according to our research. A proactive portfolio review is one in which thorough analyses are performed using financial and nonfinancial data, as well as analyses of current and future competitive environments. This process can help you recognize a business that doesn’t fit and/or should be sold faster.

Why companies avoid an active divestiture strategy

Only forty per cent of survey respondents in the Divestiture Study say they fully embrace divestitures, and there are several factors at play. Executives often mistakenly believe they can turn around a financially failing business with little strategic value. They also often resist change, preferring to ‘keep things the way they are’ rather than making the optimal decision to divest. This can be harmful - 57 percent of companies that tried to fix a business unit rather than divesting said the value of it actually deteriorated or stayed the same over time. Management may also have emotional attachments to certain business units or feel that a divestiture is a sign they ‘failed’ the business unit. Finally, management often fears the loss of revenue or profitability resulting from divestitures, which may hurt their overall compensation.

From an operational perspective, divestitures can be difficult undertakings. More than fifty per cent of survey respondents indicated that the difficulty of disentangling a business was a significant factor in a decision to not divest. Tax can also play a role, as in many divestitures, the tax costs of each separation step can impact the economics of the proposed transaction. Finally, selling a business and restructuring the remaining company can take an emotional toll on executives as they have employees’ livelihoods at stake.

Each of these reasons, while legitimate, are not grounded in a decision-making process that seeks strategic or financial value for the company.

Active portfolio review

Active portfolio review is required to remain relevant as a company. We recommend an evaluation is done as part of your forecasting cycle. If executive management is not proactive on this front, stakeholders will push your company to assess which assets are no longer consistent with your long-term corporate growth values.

The resulting divestments generate funds that can be reinvested into optimizing the core business, or developing/acquiring new activities/capabilities. High interest rate environments make it expensive to obtain bank financing. In some instances, divestments are one of the cheapest and most effective ways to access new capital. Having a robust reinvestment plan upfront - knowing what the proceeds will be used for - increases the likelihood of executing on a divestiture decision.

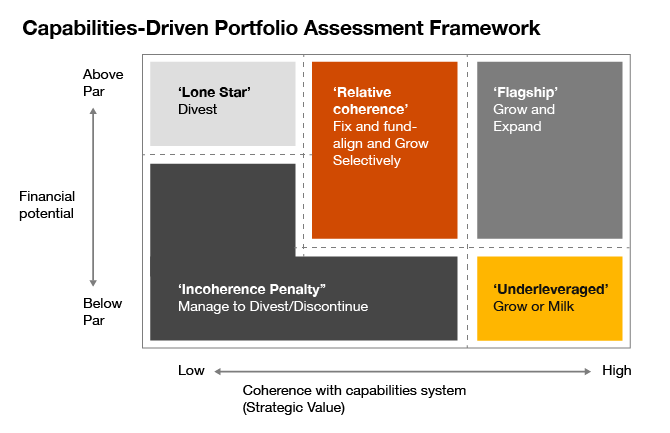

As a company you must ensure you have the right combination of activities and capabilities to make confident decisions to unlock, protect and enhance value, while enticing potential bidders. Two elements are key in this corporate portfolio assessment: financial potential and strategic value. Generally speaking, business units that do not have a clear and coherent strategic value are considered for divestment.

Keys to a successful divestiture

Proactively review your portfolio, assess strategic options, and make the decision to divest are key to a successful divestiture. Speed of execution is critical. Even though a divestiture can help create value, about thirty percent of companies take more than a year to announce the transaction after making the decision to divest. In our experience, this delay risks eroding stakeholder return. We have learned key lessons in driving an efficient and effective divestiture:

- Companies must establish a strong exit story at the start and back it up with a deal value bridge that has undergone thorough diligence.

- Perform a robust exit readiness assessment to identify key issues early on, and set out a clear plan to remediate those issues.

- Create a clearly-defined plan for a transitional services agreement (TSA) with a realistic time period in order to avoid disagreements between buyer and seller after the close.

- Anticipate the financing needs, including financial reporting requirements, of your buyer pool in order to begin preparing the needed carve-out financial statements, including audits.

- Have a comprehensive data extraction methodology and take a data-driven approach to building the financial information needed to support the deal. This allows you to flex the deal perimeter quickly and accurately as assets move in and out.

- Assemble a cross-functional team to address the transformational nature of a divestiture - this means aligning both primary functions (e.g. sales and operations) and support functions (e.g. tax, finance, HR) to make sure inter-dependencies are understood.

- Ensure open and transparent communication with all stakeholders, including employees, customers, suppliers, and regulators, for a smooth transition and minimal disruptions.

In summary, companies need to take a proactive approach towards portfolio optimisation or someone else will, or they are at risk of destroying value. Once decided, the carve-out process should start immediately with thorough preparation of the perimeter, the value creation story and the processes required for a successful divestiture. Only then will companies be able to maximize value from the portfolio optimisation process.

Contact us