Major impact energy crisis on profitability Dutch companies

29/11/22

Rising energy prices causing significant increase in costs

Rising energy prices in the Netherlands - which can partly be attributed to gas supply restrictions from Russia - are severely affecting companies in the metal, chemical, and crop, farming and livestock sectors, particularly because other production costs have also increased. This was highlighted in the research conducted by Strategy&, which is part of PwC. Based on the recent energy costs incurred by companies, Strategy& calculated the potential impact on, for example, the profit margins and production costs of companies.

Greenhouse horticulture highly susceptible to rising gas prices

Companies that rely on high-energy input materials like gas have felt the impact of the rising prices, as shown in image 1. This means metal (71 percent), chemicals (87 percent), crop farming and livestock (81 percent) companies have seen a major increase in their variable production costs. It is noteworthy that Dutch producers of crops and livestock have experienced the biggest increase in production costs in the whole European Union (EU).

Image 1: comparison rising Dutch production costs versus EU countries

Energy expert Gulbahar Tezel from Strategy&: ‘The Dutch horticulture sector is accustomed to producing crops in greenhouses. This means the sector uses a lot of gas, which probably explains why the increase has been so high. Just like other gas-intensive sectors, the greenhouse sector is highly susceptible to the rising gas prices. In the rubber and plastics industry, energy costs have not only caused an increase in the price of gas, oil and coal, but also in the price of chemicals that are used in the production process. As a result, many Dutch sectors are being hit hard. The Dutch gas price is relatively high compared to the EU average. This can be attributed to various factors, such as restrictions in international transport capacity, a decrease in long-term contracts, and regulatory differences. Since gas forms a relatively large share of the Dutch energy mix, the Netherlands is heavily impacted. Other European countries, such as France or Germany, are hit relatively less due to a larger share of nuclear energy.’’

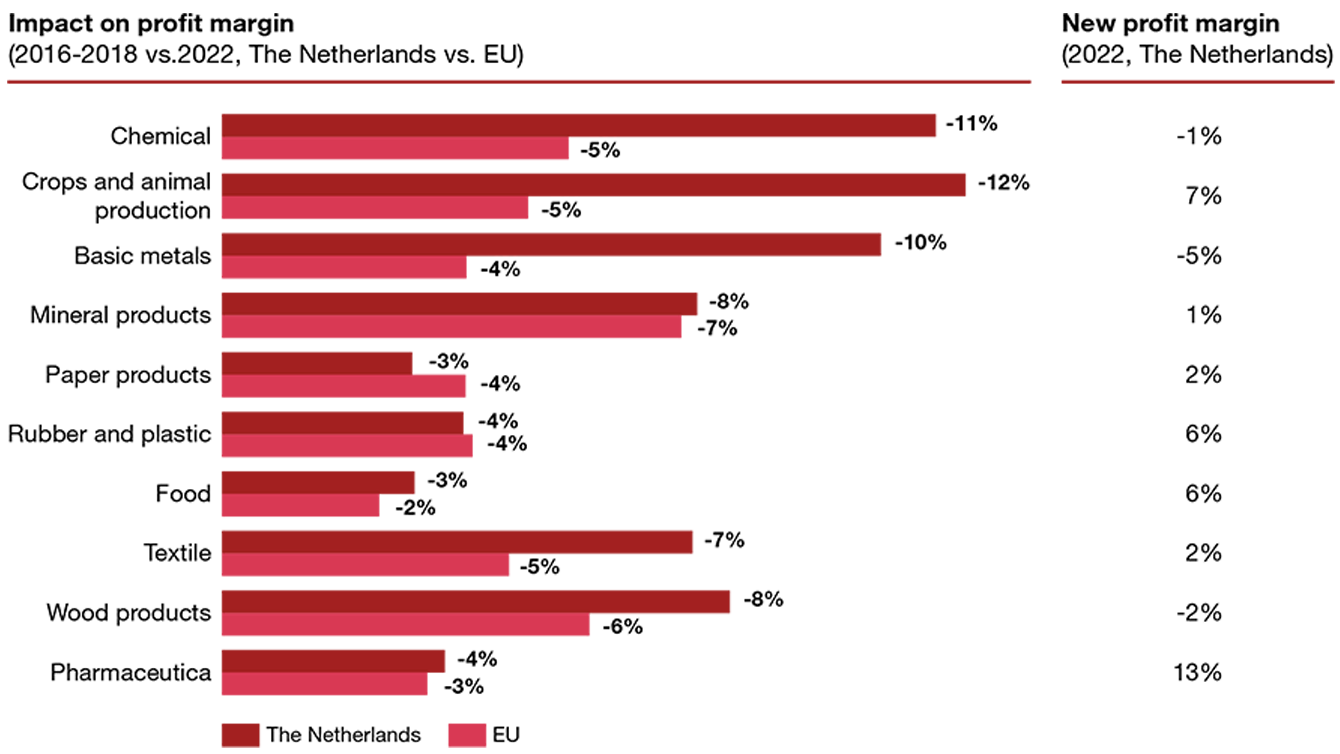

Profit margin in almost every Dutch industry lower than EU average

If we look at profit margins, it is clear that the decrease has exceeded the EU average in almost every industry in the Netherlands, as shown in image 2. Only companies that produce mineral products, and producers of rubber and plastic, have been able to keep up with the EU average. The profit margin of crop farming and livestock companies has decreased by twelve percent-point. Nonetheless, the average profit margin of companies in this sector continues to be positive (seven percent). However, this does not apply to companies that are active in the wood, metal and chemicals industries. Due to the higher costs, the profit margin in these industries has now become negative.

Image 2: change in profit margin between 2016 and 2022, excluding costs of borrowed capital and equity capital

Energy consumption not normally prioritized in production processes

Menno Braakenburg is an energy expert at Strategy&, and was closely involved in the research. Braakenburg advises companies to examine how they can be smarter when managing their energy consumption, so that costs can be restricted. ‘Firstly, it is important to examine the efficiency of energy-intensive processes, because energy consumption is often not prioritized in production processes. In addition, it is worth exploring which types of innovative contracts can be agreed with energy producers. Other options include using renewable energy to generate electricity in-house and/or to buy batteries that make it possible to match in-house production with demand in the industry.’

All throughout the EU, energy intensive industries like the metal sector, the minerals sector and the chemicals sector will see an average increase in variable costs of 40 to 50 percent. Because it is becoming difficult for EU countries to access gas, their production processes have become less competitive in the global market, while imports into Europe are becoming more competitive in terms of costs. Tezel: ‘The current energy crisis demonstrates why it is important for the Netherlands and Europe to diversify their energy mix. Increasing the capacity of sustainable energy sources is not only good when meeting climate-related targets, but also significantly reduces our reliance on oil, gas and coal.’

Projected scenario energy and production costs

Gulbahar Tezel says that the implemented model is based on a projected scenario, and is thus not a final prediction. ‘We created an input and output model containing nineteen European countries and sixty sub-sectors. The model shows the potential consequences if energy costs remain at such a high level, and if there are no changes in the energy mix. We can use the model to identify the impact of rising energy costs, and the resulting increase in other production costs.’

Contact us

Gülbahar Tezel

Partner Strategy&, Lead Denktank Energietransitie, PwC Netherlands

Tel: +31 (0)61 391 56 71

Energy - Utilities - Resources Industry Leader, PwC Netherlands

Tel: +31 (0)61 003 87 14