Technology makes paying taxes easier worldwide

30/11/19

Paying Taxes 2020

The 2020 edition of Paying Taxes has been launched. A unique report from PwC and the World Bank Group which measures and assesses the ease of paying taxes across 190 economies. This year’s survey shows that, usually as a result of increased and more efficient automation of both the filing and payment systems, it becomes easier for businesses to comply with its tax obligations.

Paying Taxes creates insights in tax systems

With this research PwC creates insights into the different tax systems and the consequences for taxpayers. The data collected year after year enables governments around the world to reflect on their tax systems. This encourages governments to design their tax systems more efficiently.

Impact of digital innovation clearly visible

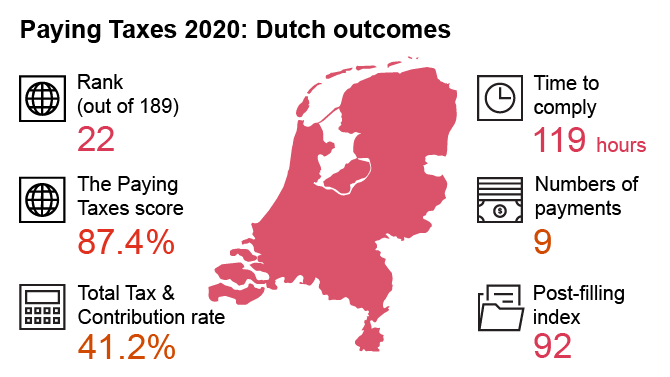

Paying Taxes 2020 draws upon a comparison of the taxation of businesses in 190 countries across the four key measures used to evaluate ease of paying taxes for businesses: the time to comply, the number of payments required, the total tax and contribution rate and a post-filing index.The survey models business taxation in each economy using a medium-sized domestic company as a case study.

With fifteen years of data and analysis of tax systems in 190 countries, Paying Taxes 2020 allows you to see the impact of (digital) innovation anywhere in the world.

Paying Taxes 2020: key findings video

Paying Taxes, now in its 14th edition, continues to be a unique study from PwC and the World Bank group which investigates and compares tax regimes across 190 economies worldwide using a case study company. It measures the relative ease of paying taxes by looking at the time the company requires to prepare, file and

Results of the survey

Overall, the global average of the compliance burden for business taxation remained relatively stable across the four key measures used to evaluate ease of paying taxes for businesses: the time to comply, the number of payments, the total tax and contribution rate and the post-filing index.

Sustained focus on technology

This year's survey re-addresses the question of how technology can help to reduce the administrative burden when meeting tax obligations. The use of technology certainly plays a role in this: since 2004, the average time spent by entrepreneurs on their compliance has decreased by 87 hours (to 238 hours) and the average number of payments that entrepreneurs have to make has decreased by 11.0 (to 23.5). Technological advances drove both improvements.

Read more on the technological solutions which are used to promote tax compliance and how you can use them to reduce the administrative burden.

Data-explorer

Dive deeper into the most prominent shifts in tax policy with the data explorer. This allows you to see how the Netherlands relates to others around the world, and compare these data.

Deployment of technology by the government

New technologies offer tax administrations many opportunities to make the process of paying taxes more efficient. This is constantly evolving. It is important that tax administrations keep abreast of and use technological developments, for themselves as well as for taxpayers.

Shift to indirect taxation continues

The study confirms the shift towards consumer taxes as VAT is becoming a tax of choice to help governments generate revenue. For example, Saudi Arabia, the United Arab Emirates and the Bahamas have introduced a VAT system. In Paying Taxes, PwC discusses various strategies for its implementation and their effects.

'Accelerate the real simplification of the income tax system and embrace the development of technological innovation next to the continued use of legacy-systems. Too much focus on organizing and maintaining the current IT-infrastructure can put a strain on innovation, R&D and the broad-based deployment of new technologies.'

Paying Taxes in the Netherlands

Paying Taxes 2019 shows that the Dutch figures have remained almost unchanged. The Total Tax and Contribution Rate measures measures how much tax businesses pay. This is defined as the sum of all taxes and mandatory social contributions paid, expressed as a percentage of the company's commercial profit. For the Netherlands, this is 41.2 per cent (last year 40.8 per cent). This slight increase is caused by labour related taxes.

The number of taxes that companies have to pay has remained the same (9 in total) and companies spend an average of 119 hours preparing, filing and paying the returns, just like last year. This puts the Netherlands in 22nd place in the overall ranking.

PwC also supports your digital transformation

Where we point out to governments the possibilities of using technology in compliance, we advise companies to integrate new technology into their own operations in order to be able to meet the continuing, increasing demand for data from the tax authorities.

Digital platforms

In our fast-digitising world there are various technological developments. A striking example of this is the digital platform. A digital platform can be regarded as an ecosystem. It grows along with supply and demand, transforms and is therefore a dynamic co-creation of the parties involved.

Digital platforms are the connectors in this online economy. In other words, a financial online platform connects and organises the relationships between people (read: organisation) and technology (data) with the aim of providing complete financial relief.

'We see an important role for the digital platform in the transformation of the entire financial and fiscal chain.'

MyFinance

MyFinance is the new digital platform of PwC, specially developed for family and business, amongst others. With MyFinance we connect our people, knowledge and services with our customers, our network and society in a safe online environment.

Gerelateerde content

Tax Function of the Future

People's view of taxation is changing worldwide. The fiscal function in organisations is thus also changing, which is having a major impact on the role of tax...

Tax

Tax within organisations is undergoing a transformation that requires modern processes and a redefinition of the role of tax within your business.

Contact us