Tax Transparency: Is your company ready for Public CbCr?

20/01/23

A new era in Tax Transparency

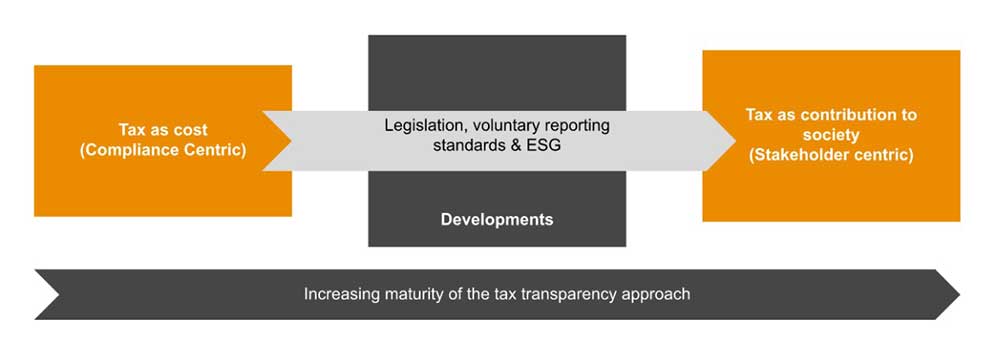

The perception of tax has changed. Tax is no longer seen as a basic cost of doing business, increasingly it is being viewed as a powerful indicator of a company’s societal impact and a reflection of its broader values and purpose. The tax footprint of an organisation - how much taxes are paid, and to whom - is also something investors and the public are increasingly asking companies to report on, most notably in the context of the broader ESG agenda (Environmental, Social and Governance). Tax transparency is being factored into stakeholder considerations when assessing the sustainability of a business.

For many businesses, tax transparency is an opportunity to build trust with stakeholders and provide assurances that they are adopting responsible tax practices.

By building trust in tax reporting, companies can help establish trust in other areas.

Is your organisation ready for public CbCR and can you use your public CbCR to substantiate your ESG ambitions?

Country-by-Country Reporting goes public

Mandatory reporting

The momentum from policy makers requesting businesses to make greater tax disclosures has been building for years, resulting in the continuing introduction of legislation mandating public reporting of certain tax data. One of the most significant developments was the introduction of country-by-country reporting (CbCR) in 2015 on foot of the recommendations in the OECD’s base erosion and profit shifting (BEPS) package. CbCR requires large multinationals to report certain financial information (e.g. corporate tax paid, revenue, profit and employees) at a country level rather than globally.

In December 2021, the EU Public Country-by-Country (“Public CbCR”) Reporting Directive entered into force. This Directive requires multinational groups with a total consolidated revenue of at least EUR 750m, whether headquartered within the European Union or not, to publicly disclose the corporate income tax they pay in each EU Member State.

Furthermore, they are required to disclose the corporate income tax paid in countries that are either on the EU list of non-cooperative jurisdictions for tax purposes (the “EU blacklist”) or listed for two consecutive years on the list of jurisdictions that do not yet comply with all international tax standards but have committed to reform (the “EU grey list”).

Similarly Australia has drafted a Public CbCR bill. The bill is expected to be implemented on 1 July 2023 and will have global implications. Due to these two developments, the Financial Accountability and Corporate Transparency (FACT) Coalition - a non-partisan alliance of more than 100 state, national and international organisations - has requested the U.S. Securities and Exchange Commission (SEC) to incorporate public CbCR in the SEC tax disclosures for certain large filers based on the standards developed by the Global Reporting Initiative (GRI).

Voluntary reporting

As a result of the mandatory reporting requirements, the voluntary reporting landscape has evolved significantly over the recent years. Stakeholders expect companies to not only comply with the mandatory requirements introduced, but to continue to build on them and increase their voluntary tax reporting too. Overall, the focus on voluntary reporting has experienced an intensification over recent years, with companies disclosing evermore detailed information about the organisation’s tax profile.

Tax transparency & ESG reporting

As the broader ESG agenda (Environmental, Social, and Governance) continues to come to the fore - spurred by investors, policymakers, employees, suppliers and customers - organisations are now considering their purpose beyond just financial growth. This means finding a balance between financial returns, social interests, the environment and transparency.

Companies can choose to follow a range of tax transparency frameworks (such as GRI 207, the B Team Responsible Tax Principles and the VNO-NCW Tax Governance Code) when considering their approach to tax disclosures.

Some common themes that emerge from these frameworks include:

Having a published tax strategy

The importance of board oversight of a company’s tax affairs

Having good tax governance and risk management procedures embedded in the organisation

Providing insight in the total tax contribution, often distinguishing between taxes borne and taxes collected.

Independent of what tax reporting framework a business applies, it is valuable to thoroughly analyse and understand what story your organisation actually tells, especially in light of the public country-by-country reporting.

What can you do?

Data coupled with a clear and compelling story towards various stakeholders, including tax authorities and the general public, will help the company to manage its tax and reputation risks effectively. Therefore, it is important to analyze your data thoroughly, regardless of the type of reporting.

This will allow you to spot outliers and proactively tackle possible related questions, in case your data does not support your company’s narrative. Moreover, it will allow you to assess whether your CbCR is aligned with any other ESG disclosures of your company.

To see what information your organisation is required to disclose, please check the table below.

CbCR |

Public CbCR (EU) |

GRI |

|

Mandatory/Voluntary |

Mandatory for MNEs with consolidated turnover of EUR 750 or more |

Mandatory for MNEs with consolidated turnover of EUR 750 or more |

Voluntary |

Report publicly available? |

Report only available to the tax authorities |

Report available publicly |

Report available publicly |

Required information |

|||

Name and year concerned |

✔ |

✔ |

✔ |

Tax jurisdiction |

✔ |

✔ |

✔ |

Revenues - total |

✔ |

✔ |

✔ |

Revenues - third parties |

✔ |

✔ |

✔ |

Revenues - related parties |

✔ |

✔ |

✔ |

Profit/loss before tax |

✔ |

✔ |

✔ |

Income tax paid (cash basis) |

✔ |

✔ |

✔ |

Income tax accrued |

✔ |

✔ |

✔ |

Stated capital |

✔ |

||

Accumulated earnings |

✔ |

✔ |

|

Number of employees |

✔ |

✔ |

✔ |

Tangible assets or other than cash and cash equivalents |

✔ |

✔ |

|

List of constituent entities per tax jurisdiction, including primary activities |

✔ |

✔ |

✔ |

Reasons for difference between income tax accrued on profit/loss and the tax due based on statutory tax rate |

✔ |

||

Total employees remuneration per tax jurisdiction |

✔ |

||

Taxes withheld and paid on behalf of the employees per tax jurisdiction |

✔ |

How can we help?

We can assist in this upfront analysis on various levels.

High-level visualization of the organisation’s CbCR data in terms of various relevant financial indicators. This outcome of the visualisation will be shared in a summary slide deck.

Visualization and analysis of the organisation’s CbCR data plus an interactive workshop in which we can “slice and dice'' the CbCR data in Power BI. The visualization and our key observations will be shared in a summary slidedeck.

Assessment whether your CbCR data aligns with other ESG reports / disclosures of the company, including an interactive workshop with both tax as well as ESG specialists in this area

Effective tax rate, TCC, or tax narrative benchmarking analysis based on publicly available data and our own bespoke database. The analysis provides you with in-depth insights into what drives your tax profile and how to communicate this to internal and external stakeholders.

Curious? Click here to read more about (public) CbCR or reach out to one of our advisers.

Contact us