Proposal for EU Customs Reform

19/05/23

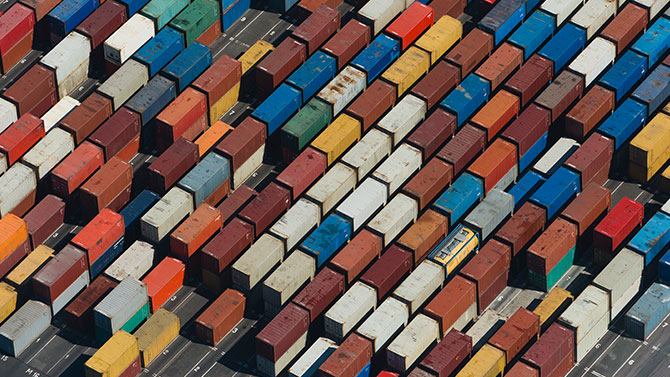

On 17 May 2023, the EU Commission published its proposal for a broad and ambitious reform of the EU Customs Union. The proposal entails a radical restructuring into a modern and more centralised system.

What does this mean for your business?

The proposal for the new structure is aiming to enhance and harmonise the customs controls and at the same time facilitate trade for businesses and e-commerce. For this a data driven approach will be implemented using a new central EU Customs Data Hub. This hub will be the central portal through which the information will be exchanged between traders and the customs authorities and thus a new way of exchanging data. Furthermore, e-commerce imports will be simplified including its import tariff structure.

Some elements of the proposal

Through the proposal the EU Commission wants to harmonise the handling of the customs formalities and uses centralisation for achieving this. In this respect the EU Commission proposes, amongst others, to:

- establish an EU customs agency which should organise the EU risk assessment,

- implement a data driven approach combined with an EU Customs Data Hub,

- implement a specific e-commerce customs tariff with a limited number of rates and abolishment of the 150-euro exemption, which should simplify imports and also improve the collection of customs revenues.

This ambitious approach will be a drastic change in the customs landscape to which both the local customs authorities as well as the traders and importers will have to adjust its processes and procedures.

How can we help?

The proposal has now been released and will be subject to discussion in the EU-parliament and EU-council. Therefore, how and to which extent the proposed changes will actually be implemented must be awaited. We will continue to monitor these discussions and will provide updates once further developments become known.

Related Content

Charging of electric vehicles is a supply of goods for VAT

After a long period of uncertainty, the CJEU rules that charging of electric vehicles is a composite supply consisting of a supply of goods for VAT purposes.

Changes on origin documents for claiming preferential origin

As of 1 January 2023, Form. A document can no longer be used for claiming GSP treatment and REX documents cannot be used for goods with Vietnamese origin.

Introduction of binding information on customs valuation?

The EU Commission has taken initiative for the introduction of binding information on customs valuation (BVI).

Contact us