CEOs throughout the world realise that their company will not be viable in 10 years’ time unless they make changes. Almost half of the CEOs in the Netherlands think that their company will no longer be viable in the long term if it continues on its current course.

This is one of the key findings of PwC's 26th CEO Survey, an annual deep dive into the views of executives on the economy, their company and the environment in which they operate. The survey also shows a sharp fall in CEO optimism compared to last year, when the Covid-19 epidemic was largely behind us and when invasion of Ukraine had yet to take place. The survey covered 4410 CEOs worldwide, 85 of them in the Netherlands.

CEOs mustn’t lose sight of the long term

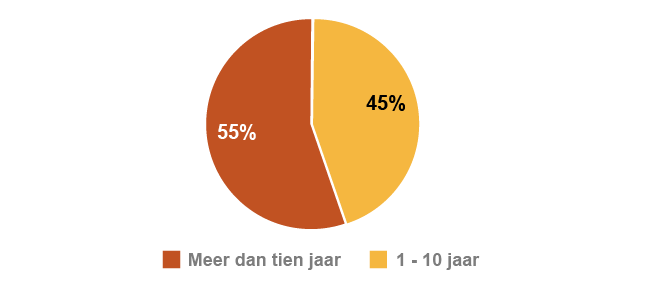

In the Netherlands, 45 per cent of CEOs think their company will need to change if it is to remain viable in the next 10 years. “Companies' resilience is being tested in these times of high energy prices and inflation,” comments Agnes Koops-Aukes, CEO of PwC Netherlands. “At the same time, we’re in the midst of an energy transition, technological developments are continuing apace, the labour market remains tight, and companies are having to deal with many new regulations. Together these factors are going to force most firms to undergo a major transformation.”

If your company continues running on its current path, for how long do you think your business will be economically viable?

CEOs face multiple dilemmas

Koops-Aukes sees the dilemmas that CEOs are currently facing: How do I divide my attention between managing acute challenges and investing in the future?’ Will I pass on the high energy prices to customers or will that overly affect my international competitiveness?

“The survey makes clear how much attention CEOs are paying to urgent short-term challenges that are primarily related to the high inflation levels of the past year,” continues Koops-Aukes. “They are responding to these challenges by passing on higher costs to their customers, reducing operational costs and revaluating current projects. At the same time, the vast majority of CEOs are continuing to invest, especially in automation processes and systems. While there is then a focus on reducing costs, this comes with an explicit goal of making future-oriented investment possible. Managing the trade-offs this approach entails on a daily basis – finding a balance between short- and long-term challenges – is no easy matter.”

Concerns about inflation and labour shortages

The CEO Survey brings to light the tensions between the long and the short term. Executives in the Netherlands see inflation, economic volatility and geopolitical instability as the biggest threats for the next 12 months. In the long term, they think the scarcity of workers and new regulations will have the greatest impact on their profitability.

How exposed do you believe your company will be to the following key threats in the next 12 months? (Only high and extreme exposure)

To what extent do you believe the following will impact (i.e., either increase or decrease) profitability in the ... industry over the next 10 years? (Only 'large' and 'very large' extent)

Large majority of CEOs expect economic downturn

While 80 per cent of CEOs still assumed that the economy would grow in last year’s survey, the same number now foresee a deterioration over the next 12 months. The results of the CEO Survey show that CEOs in the Netherlands are more pessimistic about the country’s economic developments than their global peers. Some 89 per cent think the domestic economy is deteriorating while the worldwide figure is 59 per cent.

A ‘perfect storm’ with structural causes

“That really is a big difference,” says PwC’s chief economist Jan Willem Velthuijsen. “We can only attribute it to a ‘perfect storm’ of high prices and a tight labour market, which is worse in the Netherlands than in other countries. The Netherlands is also far more sensitive to high energy prices as its economic structure is strongly based on fossil-fuels.

“For the same reason, the energy transition is likely to be more expensive for the Netherlands than other countries. Dutch companies also find it harder to pass on higher prices as they’ll quickly price themselves out of the market on a world trade level. In addition, Dutch companies and households have higher debts compared to other countries, which means that interest rate increases limit spending power more.

“This perfect storm has put the country into reverse with regards to productivity within six months as companies incur far higher costs than six months ago to attain the same macro-production levels. Moreover, this problem cannot be solved overnight because the causes are structural.”

The importance of European unity

PwC Netherlands also asked CEOs about the role of unity within the European Union and a large majority of respondents consider this to be either important or very important. “Some of the structural factors that mean we get hit twice as hard are typically Dutch and require a Dutch approach,” adds Velthuijsen. “Others such as energy and climate are much better tackled at the EU level. What’s more, 80 per cent of our exports go to the EU, making it the biggest trading partner. There are no benefits to the Netherlands of an unstable EU.”

How important is unity within the European Union for your business (activities), given political, economic and financial turbulence?

Contact us