Accountability lays the foundations for progress

The time for transparency has come. The path that organisations are following today in the area of ESG calls for openness and verifiability. PwC experts Karin Meijer and Willem-Jan Dubois are convinced that accountability lays the foundations for progress. Drawing on their expertise, they explain what they mean by this and why transparency is so essential if you want to optimise your ESG reporting and insights. Part two in a three-part series on sustainable reporting.

Karin Meijer

‘Being transparent and ambitious is inspiring to others’

‘Being transparent and ambitious is inspiring to others’

For thousands of years, no one had managed to run the mile in under four minutes. Until 1954, that is. British athlete Roger Bannister clearly stated his ambition. On the track he strained every sinew and, to loud cheers and applause from spectators as he rounded the final bend, ran his way to lifelong fame. Bannister was an inspiration, because less than two months after he had made history, another athlete repeated this feat. How could that be?

‘Being transparent and ambitious is inspiring to others’, says Karin Meijer, a specialist in ESG (Environmental, Social and Governance) reporting. ‘It can be a mirror that spurs you on to improve, also as an organisation.’ Transparency helps you identify where you need to act, on both a strategic and an individual level. ‘And gaining an insight into your own actions and those of others can make you reflect on yourself’, adds PwC’s ESG Consulting Lead Willem-Jan Dubois. ‘Accounting for what you do, how you do it and the results you achieve forms the basis for this. Through reporting you offer transparency and that prompts you to think and act.’

From cold feet to clear ESG goals

‘Being transparent is no longer a choice, but an obligation imposed by legislation, as well as by stakeholders, such as investors, suppliers, governments, customers and employees’, Meijer explains. It is not without reason that transparency forms one of the key pillars of European regulation in the area of sustainability reporting. ‘European legislation focuses on the allocation of capital, the integration of ESG into risk management and the creation of transparency about an organisation’s long-term vision. There is a clear link between these principles.’

Many organisations have already come to realise that transparency is needed in the area of ESG. Newspapers are full of articles on the impacts of climate change and published climate reports are ringing alarm bells. Companies and organisations are expected to demonstrate their ability to withstand (future) shocks, a matter of great importance to investors. Society as a whole, meanwhile, is demanding that companies take responsibility and work to minimise their negative impact and create a positive impact in the three ESG areas.

Despite the seriousness of the situation, it is taking a while for companies to get used to this. Meijer: ‘We therefore help organisations to formulate climate objectives. Companies are used to dealing with sales targets – targets based on figures they know and understand. When it comes to setting ESG targets, things are a little more hazy and it’s harder to figure out whether targets are achievable. Most companies struggle to decide between ambitious targets and realistic targets. As far as I’m concerned, it’s simple. We have to meet the target set by the Paris climate agreement, but companies are nervous about committing to it. We can help them.’

Don’t report on everything – dare to choose

Transparency does not mean reporting on everything. It is about making choices and deciding on a clear approach. Thinking carefully about which KPIs your organisation chooses to report on is essential. ‘Transparency is about what is materially important to your stakeholders’, says Dubois. ‘That may be twenty strategic KPIs, but not fifty. It’s important to be focused.’

‘As far as I’m concerned, transparency is not just about targets and KPIs’, adds Meijer. ‘Stakeholders need information on which to base their decisions. By reporting on what’s going well and what’s not, you offer them transparency. It’s important to know who your main stakeholders are and where their information needs lie.’

According to Meijer, as an organisation you therefore need to set out a firm ambition, and then demonstrate over time how successful your chosen strategy is proving to be. When it comes to articulating a firm ambition, the materiality analysis plays an important role. The process you used to arrive at that materiality analysis and impact matrix also forms part of the sustainability report. ‘The very act of communicating the process you are following to achieve your ambitions contributes to your organisation’s transparency’, says Dubois. ‘Ideally, you should also tell people what is going less well. Many organisations still find this tricky, but we advise them to do so.’

Willem-Jan Dubois

'Transparency is about what is materially important to your stakeholders’

The role of credit rating agencies

Meijer and Dubois receive many questions from the market about credit rating agencies. ‘There are so many of these agencies and they all look at different aspects and use different methods. That makes things complicated’, says Meijer. ‘The rating they issue can be extremely important, as it has an impact on access to capital.’

Many organisations are already well on the way with their ESG KPIs and ESG reporting. However, they are not yet ready to cope with the increasing torrent of demands that legislation and credit rating agencies are placing on them. Meijer recommends that organisations should also be transparent about all the preparatory work they are doing ahead of new laws, such as the Corporate Sustainability Reporting Directive (CSRD).

It is also essential to communicate about internal ambitions at an early stage, according to Dubois. ‘Suppose your company wants to reduce CO2 emissions and you therefore need to change the machines you produce. This will require a huge investment in terms of both time and money. And that’s precisely why it’s important that you also communicate this to your internal stakeholders. Make sure that all information is always traceable and available for everyone internally.’

Five conditions to achieve a transparent future

While the direction of the overall ESG journey is clear, there is much uncertainty about the exact path that should be followed and the pace of change. What are the five conditions to achieve a transparent future?

- 1. Commitment from management

- 2. Know your business strategy

- 3. Think in terms of systems rather than standards

- 4. Apply the same rigour as for financial figures

- 5. Think digital

1. Commitment from management

One of the most important conditions to achieve a transparent future is the tone at the top. The tone set by the board or management sets the standard and permeates all levels of the organisation. For internal stakeholders this is essential. ‘A good example is the CEO of an AEX-listed client. ESG is high on the CEO’s agenda and he communicates about it a great deal, both internally and externally. That works really well’, says Dubois.

How PwC can help with ESG reporting

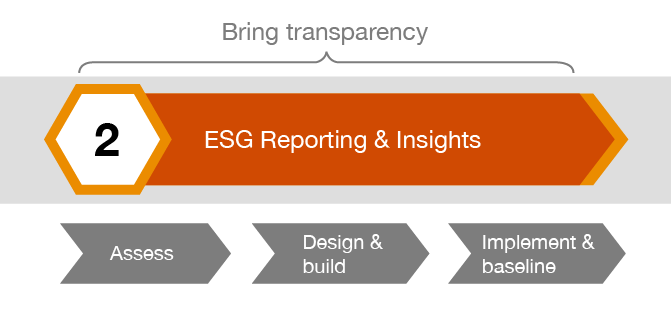

Our ESG Reporting & Insights model – choosing the right KPIs, creating transparency and becoming fit for the future – helps companies at every step and in every stage as they move towards a sustainable business model.

Together, we set the right direction by thinking about strategy and compliance with legislation. This means that we first define the ESG principles, formulate a strategy and set challenging ambitions. Once we have determined the starting point, we focus on achieving transparency. We do this by making the ESG reporting, systems and data architecture robust. An important step in this phase is choosing the right KPIs, as discussed in the first article in this three-part series on ESG Reporting & Insights.

In addition, it is essential for every stakeholder that there is transparency and that ESG is fully integrated into the organisation. In this second phase of our work, we focus specifically on the requirements of credit rating agencies, external reporting and setting the right tone at the top in the area of ESG strategy. In the above article – the second in our three-part series on sustainable reporting – you can read more about the five conditions to achieve a transparent ESG future.

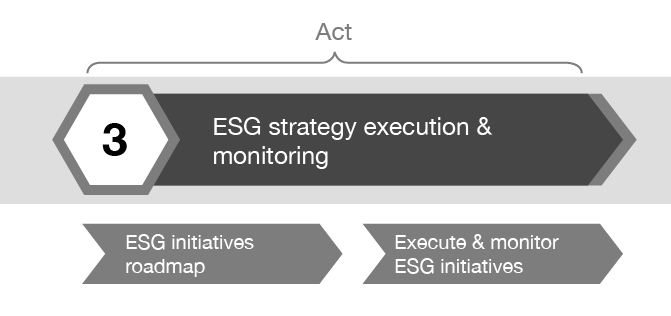

In the final phase, we focus on future-proofing your organisation, by setting up systems and control mechanisms, for example. Then it is time to take concrete action to actually realise your ESG objectives. We help to monitor progress, make adjustments based on your ESG ambitions and strategy, give your data systems greater depth, stimulate good partnerships and ‘upscale’ all employees. Here you can read all about getting fit for the future in the final article in our three-part series on sustainable reporting.