Accounting for divestitures

Seamlessly navigate complexities and unlock greater value

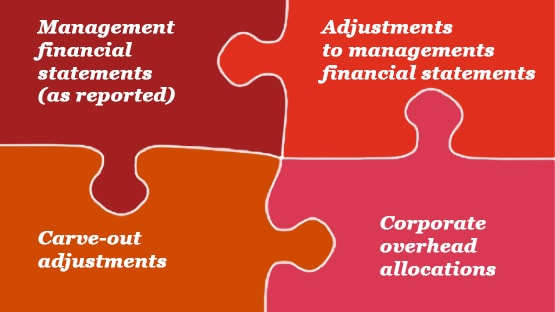

A key component of any divestiture is the preparation of the financial information around the carved-out business. Carve-out GAAP financial statements typically reflects the historical operations of the carve-out entity and all costs of doing business as if the carve-out entity operated on a stand-alone basis. These carve-out GAAP financial statements may be used for capital market transactions, to satisfy regulatory or financing requirements of the buyer, or to provide additional comfort to buyer. Deal basis financial statements and other diligence materials should reflect the business operations being divested, which may be different than the historical operations of the carve-out entity. These are vital documents as the deal process unfolds, whether to support an IPO, spin-off or sale transaction.

Preparing financial information for the business to be divested is one of the most complex issues in the execution of a sale or spin-off. So how do you navigate? Understanding the ins and outs of divestitures, and the potential impact to both buyers and sellers, will pave the road to a successful transaction and realization of deal value.

Data-driven strategies and insights:

With the emergence of sophisticated digital platforms, companies today are collecting granular transactional information on their products, customers, suppliers and operations. Harnessing this internal data and combining it with external data in meaningful and dynamic ways is becoming a standard requirement for management to identify objective insights across all functions in order to make more informed decisions.

Key success factors critical to any divestiture include technical accounting and regulatory environment knowledge coupled with robust data strategy, and analytical skills around the tactical data extraction and separation process. By leveraging technology and automating certain components of the carve-out information, management can gain faster and richer access to the carve-out data. Having a dynamic data platform also allows you to update financial information in a controlled environment quickly if the transaction perimeter changes, enabling you to pivot efficiently to address stakeholder requirements.

PwC’s divestitures team equips you with data-driven insights and know-how to facilitate rapid and reliable analysis of data, uncovering more and going deeper with greater visibility into your strategic options.

Getting good advice

Carve-out transactions involve a high degree of complexity. We recommend proactively assessing the financial reporting and accounting implications related to carve-outs. Then, supplement existing in-house finance, accounting, and external audit resources with deal team members who deliver independent carve-out advice on M&A and capital markets transactions.

PwC can be your trusted advisor. We work with you at any point in your journey, using the latest technology and data analytics tools, to deliver the objective insights you need to help make the right decision at the right time. With holistic advice that considers your entire business, PwC can help you set your sights high and execute the roadmap to get you where you want to be.

Visit PwC Accountancy Insights for articles and videos on accountancy.