IFRS 9

A new standard for the accounting of financial instruments

In 2014 the IASB (International Accounting Standards Board) issued the new standard (IFRS 9) for the accounting of financial instruments. The reason for this new standard is that many financial institutions experienced that the requirements in the old standard (IAS 39) were difficult to understand, interpret and apply. To address the deficiencies of the old standard, a new standard (IFRS 9) for the financial reporting of financial instruments that is more principle-based has been introduced. IFRS 9 has an effective date for annual periods starting from 1 January 2018. Our guidance on IFRS 9 follows the three main phases of the standard:

- Classification and measurement

- Impairment

- Hedge accounting

The first phase of the IFRS 9 provides guidance on the classification and measurement of financial instruments. IFRS 9 requires that all financial assets are subsequently measured at:

- Amortized cost

- Fair value through other comprehensive income (FVOCI),

- Fair value through profit or loss (FVPL)

Whether a financial asset is classified as amortized cost, FVOCI or FVPL is mainly based on the business model assessment and the SPPI-Test (Solely Payments of Principal & Interest).

The main change in the classification and measurement of financial liabilities is the recognition of changes in own credit risk in other comprehensive income for liabilities designated at fair value through profit or loss.

This might be the least complex area of the new standard but for Banks and other financial institutions with considerable financial assets on their balance sheet, this might have a significant impact.

Related download

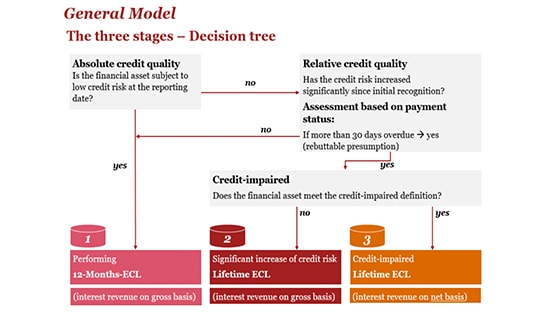

IFRS 9 contains requirements for a new impairment model which will result in earlier recognition of credit losses. The main difference with the old standard (IAS 39) is the change from using an incurred loss model to an expected loss model. This will have a significant impact on loan loss provision and capital requirements for banks and other financial institutions.

The new requirements on impairment provide institutions with more useful information in their financial statements about their expected credit losses on financial instruments, being more foreword looking. With this information institutions can notice financial risks earlier as well.

Related download

The new general hedge accounting requirements added to IFRS 9 reflect the IASB’s goal to simplify hedge accounting. The standard aligns also hedge accounting more closely with the risk management activities undertaken by institutions and provides decision-useful information about an entity’s risk management strategies. The new hedge accounting model makes it possible for institutions to present their risk management activities better in their financial statements and is more principal-based than the previous IASB model. The changes on hedge accounting include the requirements for the General hedge accounting. IFRS 9 provides an accounting policy choice: entities can either continue to apply the hedge accounting requirements of IAS 39, or they can apply IFRS 9. This is a choice banks and other financial institutions are having to take into consideration.

Related download

How can PwC help?

Our team has experience in helping financial institutions successfully complete the transition to new accounting standards. As well as helping you to get the numbers right and we can guide you through the operational challenges. Our flexible and scalable methodology focuses on effective knowledge transfer, in order for you to get lasting benefits. We can help you with your IFRS 9 transition through:

- Project management support

- Technical and accounting advice and support tools

- Learning and change management support

- Valuation and impairment testing

- Processes, data and systems

Contact us