{{item.title}}

{{item.text}}

{{item.title}}

{{item.text}}

The EU aims to reduce its net greenhouse gas emissions by at least 55 percent by 2030, compared to 1990 levels, and reach climate neutrality by 2050. On 14 July 2021, the European Commission presented the Fit for 55 Package with proposals aiming to deliver the 2030 CO2 reduction target and to pave the way to become the world's first climate-neutral continent by 2050. The Fit for 55 Package is an impressive 12,000 page legislative proposal effectively codifying the principles laid down in the EU Climate Law.

A number of key proposals from this package, Revision of EU ETS, Carbon Border Adjustment Mechanism (CBAM), Effort Sharing Regulation, CO2 emissions standards for cars and vans, LULUCF and Social Climate Fund, have been published in the Official Journal of the EU on 16 May 2023, after adoption by the European Parliament and the Council of the EU. On 1 October 2023 CBAM will enter into effect.

The European Climate Law has come into force on 20 July 2021. Aimed at reaching the set EU climate-neutrality objective for 2050, the European Climate Law provides for a binding EU 2030 climate target of a domestic reduction of net greenhouse gas emissions (emissions after deduction of removals) by at least 55 percent compared to 1990 levels by 2030.

With the European Green Deal, the EU is implementing specific measures aiming at achieving these climate ambitions and goals.

With the revision of the EU ETS, the overall quantity of emission allowances (the so-called “cap”) is reduced and the annual rate of reduction of these emission allowances is increased. For aviation, free emission allowances are phased out and an alignment is made with the global Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA). Shipping emissions are to be included in the existing EU ETS system for the first time. In addition, an ETS system for the buildings and road transport sectors is introduced (EU ETS II).

The CBAM introduces a levy on the importation of certain goods - iron and steel, cement, fertilisers, aluminium, electricity and hydrogen, some precursors and a limited number of downstream products - into the EU. The CBAM creates a reporting requirement for importing these goods as per 1 October 2023 and is an effective levy as per 2026. The aim is to address the risk of carbon leakage and reinforce the EU ETS. The introduction of an EU-wide CBAM creates a common and uniform framework to ensure an equivalence between the carbon pricing policy applied in the EU’s internal market and the carbon pricing policy applied on imports.

The long awaited revised Energy Taxation Directive aims to ensure that the taxation of energy products and electricity better reflects the impact they have on the environment and on health, by removing disadvantages for clean technologies and introducing higher levels of taxation for inefficient and polluting fuels.

Brief outline of the other green taxes, revisions and measures included in the Fit for 55 package.

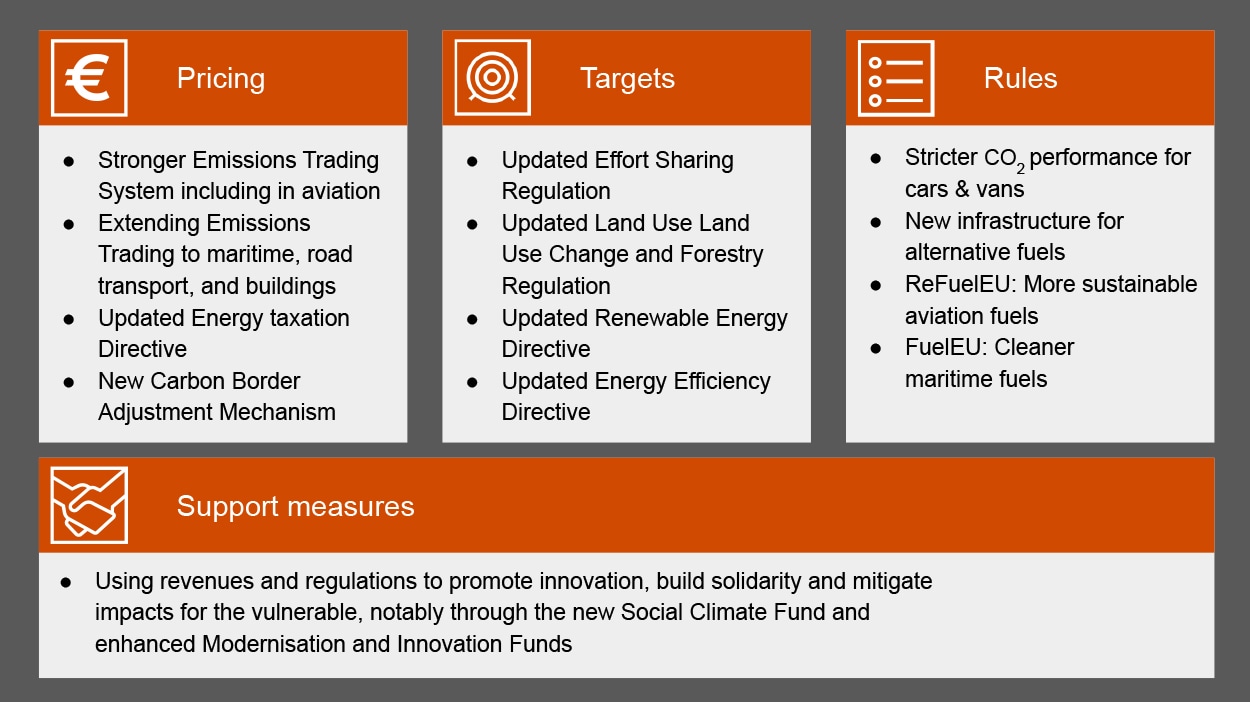

On 14 July 2021, the European Commission adopted and presented the ‘Fit for 55 Package’. A package of comprehensive and interconnected proposals for revision of several regulations and directives as well as certain new legislative proposals.

According to the European Commission, the package combines “application of emissions trading to new sectors and a tightening of the existing EU Emissions Trading System; increased use of renewable energy; greater energy efficiency; a faster roll-out of low emission transport modes and the infrastructure and fuels to support them; an alignment of taxation policies with the European Green Deal objectives; measures to prevent carbon leakage; and tools to preserve and grow our natural carbon sinks.”

Part of the building blocks consists of completely new legislative proposals and part is updates to existing EU Directives and Regulations. You find a more thorough and detailed explanation in the navigation above on:

The following elements are briefly outlined under the ‘Other green taxes, revisions and measures’.

Energy - Utilities - Resources Industry, Tax, Partner, PwC Netherlands

Tel: +31 (0)65 154 18 97

Partner, Energy transition and sustainable energy, PwC Netherlands

Tel: +31 (0)65 160 08 61

Juliette Marsé

Director (Tax) - Energy, Utilities & Resources, PwC Netherlands

Tel: +31 (0)63 419 61 08

Mohammed Azouagh

Senior Manager - Tax, Sustainability and Incentives, PwC Netherlands

Tel: +31 (0)62 380 36 54