The one solution to tackle the challenges of your global indirect tax obligations

Indirect Tax Edge is a comprehensive and easy-to-use solution that helps you take care of all your compliance obligations as well as maintaining data and process quality in one place. The web application interface hosts convenient and intrinsic workflows, predictive analytics, exception handling and intelligent dashboards enabling the user to easily manage all the chosen features.

In a time where tax authorities and compliance regulators are increasingly carrying out audits and inspections, Indirect Tax Edge is here to provide you with extra assurance in reviewing your transactional data, ensuring integrity and allowing you to meet all your current and future reporting obligations.

Backed by PwC’s global network, Indirect Tax Edge is designed as a flexible platform that can grow with your business while adapting to the global landscape of Indirect Tax. This ensures that you can begin with your urgent compliance obligations and gradually broaden and strengthen your processes whenever necessary.

Indirect Tax Edge performs:

Data and process quality

Having accurate and indirect tax data is critical in reducing the risk of non-compliance. Indirect Tax Edge provides various possibilities for the importation of this data, and it can easily extract and transform data from multiple ERP systems through manual uploads or automated integrations.

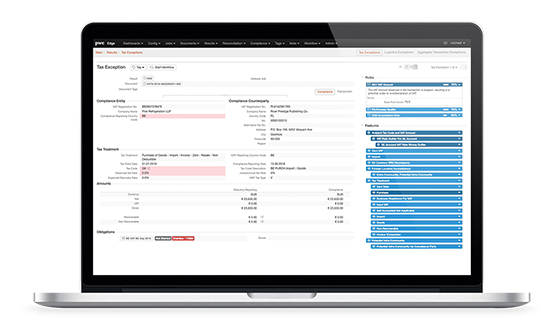

With more than 200 compliance and data quality checks in place, Indirect Tax Edge offers comprehensive validations of the underlying data. By working with a signal-based approach, a high accuracy of the exception matching process is ensured. The review and adjustment process that follows not only becomes much less time-consuming, but also less prone to errors.

Furthermore, by flagging certain transactions based on comprehensive underlying logic, the business user is quickly notified in case there is a risk of e.g., over- or underpayment. The easy-to-use interfaces of Indirect Tax Edge make it simple for users to quickly comprehend the risks. Intuitive workflows make it easy to perform checks and make adjustments where necessary.

Data analytics and insight

Data has become an incredibly valuable resource for organisations. The vast amount of data that is available to them can be analysed to gain valuable insights in various aspects of their business.

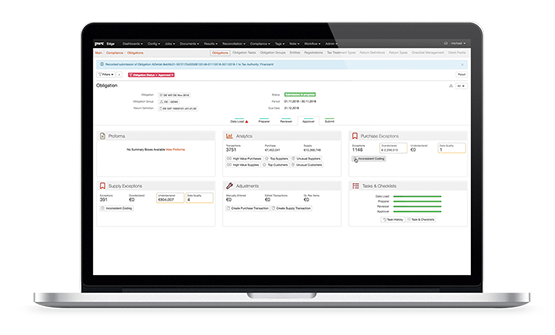

By digging into the underlying transactional data, Indirect Tax Edge generates visualisations in clear, customizable dashboards in which the user can easily read what the key factors are behind the numbers. By gaining these insights, tax and finance teams can determine follow-up steps for various business process improvements.

Period-end compliance reporting

Many organisations struggle to comply with their indirect tax compliance obligations. Manually working through this process is not only very time consuming, it is also prone to errors. Furthermore, in more and more countries an automated process is mandatory.

With data imported from source systems, Indirect Tax Edge is designed to automatically create the returns for you, lowering risk and giving a complete audit trail of actions. It includes automatic indirect tax analyses and reconciliations of indirect taxes, as well as the possibility to adjust transactions at line level and create workflows that give you complete control over sign-off..

Real-time reporting

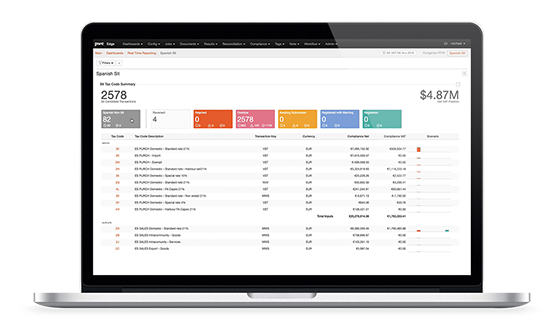

Many countries are implementing or planning to implement real-time reporting obligations in which it is required to report transactional data based on a variety of standards. The submission requirements vary per country from monthly/quarterly submissions to reporting at the moment of invoice generation.

With customisable dashboards to view and monitor and understand the status of each return, real-time reporting becomes simple to administer with Indirect Tax Edge. Your transactional data is sent to the appropriate authorities through a straightforward submission process. Before submission, Indirect Tax Edge performs various data quality checks specific to tax jurisdictions.

Benefits of Indirect Tax Edge:

- Better financial results

- Reduced workload

- Increased effectiveness for compliance and monitoring

- Enhanced business operations

- Increase data quality

- Improved understanding of transactional data

Better financial results

Preventing tax spill.

Faster processing of refund requests.

Functions for trends, discrepancy and reconciliation.

Easier recognition of tax savings.

Automated tax anomaly detection early in business operations.

Reduced workload

- Continuous monitoring, revised work and internal audits require less effort.

Optimum utilisation of current personnel and assets.

Automated business processes from source systems to tax obligations.

Well-organised processes for better productivity.

One stop solution for all your compliance & data management needs.

Increased effectiveness for compliance and monitoring

- Manage your reporting obligations with improved accuracy, efficiency and flexibility.

A single global solution.

Advanced analytics to gain a better understanding of the data.

Automated processes for less manual operations.

Enhanced business operations

- Confidentiality of data is protected and human error is reduced by using a single solution.

Workflow management.

Responsibilities can be set up for one or multiple people by assigning roles.

More efficiency and accuracy due to automated operations.

Data is automatically corrected when entering the system.

Increase data quality

- Monitor the quality of the data throughout the entire process.

Automated validations on the data quality.

Improved understanding of transactional data

- Tailor made analytics for obtaining key information.

Integration of manual checks.

Uncover valuable insights based on facts.

Automated exception detection.

Indirect Tax Edge is a scalable, adaptive solution.

Indirect Tax Edge can be applied in several ways, varying from straightforward use cases up to complicated worldwide situations. The modules Indirect Tax Edge provides can be selected based on specific business needs. Indirect Tax Edge is available in multiple service models. The compliance process can be insourced, outsourced or co-sourced, or a hybrid model can be used.

Related content

Tax Function of the Future

People's view of taxation is changing worldwide. The fiscal function in organisations is thus also changing, which is having a major impact on the role of tax...

Indirect Taxes

Robust and bold solutions for your indirect tax needs.

Tax

Tax within organisations is undergoing a transformation that requires modern processes and a redefinition of the role of tax within your business.

Contact us