Tax Management Maturity Model (T3M)

The Tax Control Framework (TCF) is part of the internal control framework and ensures that the tax function is in control. A properly designed TCF can, for example, help to identify, evaluate and manage the tax risks that an organisation may face.

An end-to-end tax risk management methodology

How do you set up a TCF that also meets the requirements of the organisation and international standards? PwC has developed the Tax Management Maturity Model (T3M) for this purpose. The T3M methodology and accompanying online tooling provide your organisation with clear insights into the operation of the tax function and detailed recommendations for improving it.

OECD standards and New Horizontal Monitoring

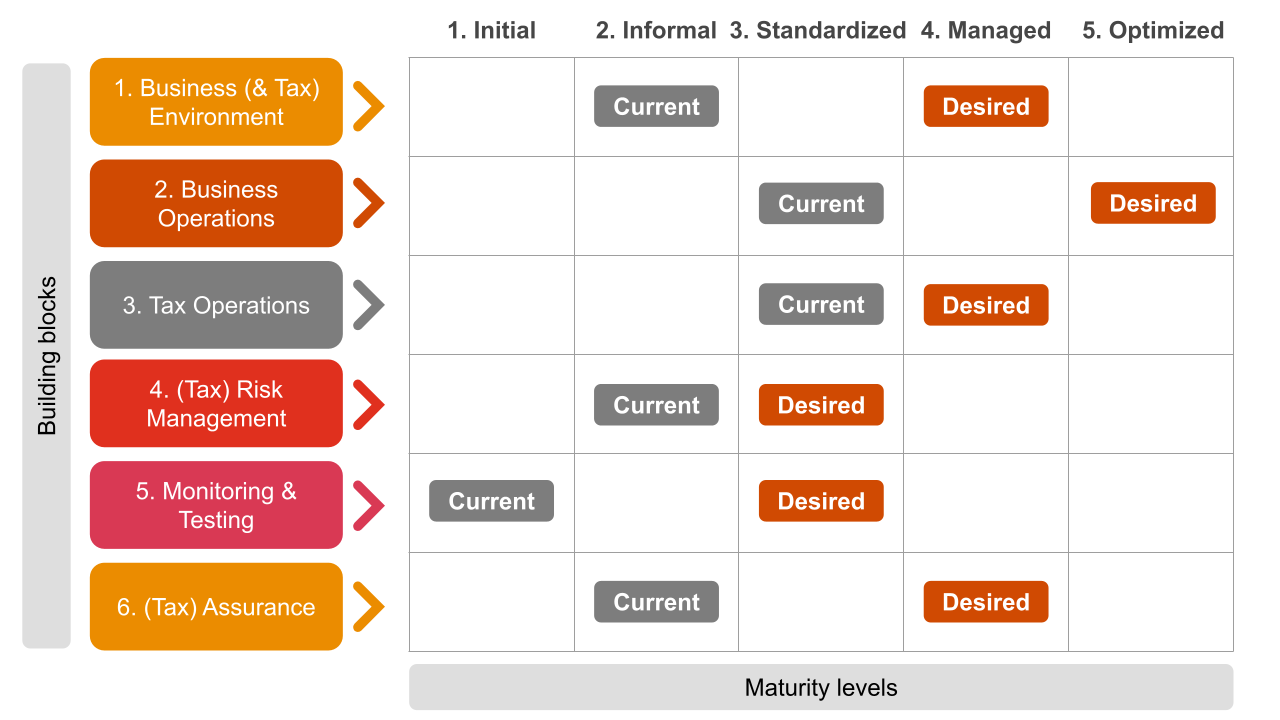

T3M consists of six building blocks inspired by COSO and is in line with OECD standards. Consequently, the T3M methodology also meets the basic TCF principles of the Dutch Tax and Customs Administration and the qualifying criteria for participation in the further developed Horizontal Monitoring. In this way T3M makes tax risk management concrete and tangible. Is my tax strategy working? Are we aligned with the business? What are our tax (key) risks and how do we manage them? Do we adequately monitor and test our (tax) processes, risks and controls? In short, are we really ‘in control’?

If you would like to know more about T3M, or what PwC can do for you, please contact us. Access to an online demo of the tool is possible of course.

What we can do for you

Work with you to make Tax Risk Management visible as part of the broader internal control framework and prioritise it within your organisation, as well as gain support for it.

Together with you, we will complete the model to determine the current and desired maturity levels of the Tax Control Framework by means of workshops or interviews.

We will draft a report with a summary of the outcomes of the model and recommendations on how to improve your tax management.

We can support you in further developing and optimising the Tax Control Framework and the tax operating model so that you reach the desired maturity level.

Highlights

End-to-end tax risk management methodology

Inspired by COSO and compliant with OECD standards

Provides insight into the maturity of your Tax Control Framework ('TCF')

Multi-tax, with attention to all types of taxes

Support in communicating your TCF to internal and external stakeholders

Possibility to benchmark with similar organisations

Supported by the global PwC network

Responsive, works on both desktop and mobile devices

Contact us