Four Pillars of Qualified Intermediary Compliance

The QI status comes with obligations. To be compliant, the next four pillars are an important part of the process.

Identification & Documentation

- Complete and correct documentation is necessary to apply reduced withholding tax rates for payments made to clients (or business partners); modifications to those rules need to be carefully monitored.

- If non-US entity clients want to benefit from reduced withholding tax rates, the so-called “limitation on benefits” must be respected (e.g. via a Treaty Statement or Form W-8BEN-E).

- Some QIs apply the so-called "joint account provision" (for certain partnerships and trusts). Under the QI Agreement, conditions and documentation required for the application of this rule are different, and QIs must (1) analyse whether the rule can still be applied, and (2) update their documentation.

- QIs must align their QI customer identification and documentation procedures with FATCA, GDPR, and KYC (AML) procedures in order to check for conflicting information but also in order to locate synergies in order to improve not only efficiencies but the customer experience.

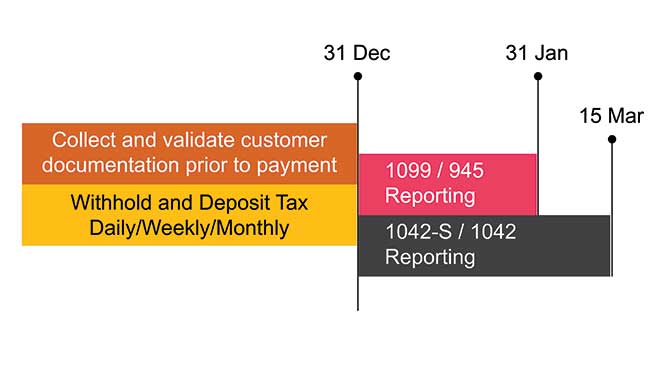

Annual Processes

Reporting

- Electronic submission of annual information reporting on e.g. Forms 1042-S and 1099. QIs must either implement a tool or seek external support for these submissions.

- The reporting forms contain changes almost every year; modifications to these forms must be carefully monitored.

- Annual reconciliations of reporting and tax deposits on Form 945 and 1042 mean it is important to align processes across affected group entities that aggregate into a single reporting taxpayer identification number. Reconciliation with upstream agent reporting to the QI is critical.

- Use of IRS transcripts helps alleviate discrepancies after filing of the Form 1042 and 945. Access to the IRS Transcript Delivery System is usually necessary in order for QIs to download these transcripts. However, historically only certain US persons with US Social Security Numbers can be granted access to this system.

Tax Withholding

- Product analysis is necessary to understand which products give rise to withholdable and reportable payments. Additional scrutiny is required for certain products that are not covered by the QI Agreement and for which the non-US financial services provider must instead continue to act as an NQI.

- A QI may or may not assume primary tax withholding responsibility. When it has not assumed primary tax withholding responsibility it must instruct and enable its upstream paying agent(s) to conduct the tax withholding. These so-called Secondary QIs remain responsible for the reporting at the end of the year.

- In case of underwithholding by a QI or its upstream paying agent the QI has a residual tax withholding responsibility. Such QI remains liable for underwithheld or undeposited taxes.

- For QIs which assume primary tax withholding responsibility, or for QIs that have a residual tax withholding responsibility, tax deposit infrastructure with the IRS via EFTPS must be established.

- Reclassification of (non-US) payments as US sourced payments for certain equity derivative products increases complexity (e.g. section 871(m) and QDD status).

Three Year Periodic Processes

Compliance & Governance

- The QI compliance program including processes and controls should be set up in a manner that it properly interacts with Netherlands and EU law requirements such as in the General Data Protection Regulation.

- The QI is required to designate a Responsible Officer who oversees the effectiveness of the compliance program and makes periodic certifications to the IRS on compliance with QI and FATCA. In this certification, any material failure or events of default must be disclosed (as defined in the QI Agreement), and remediation actions explained.

- Prior to the three-year periodic certification, a periodic review must be performed on a specific year within the three-year certification period by a sufficiently independent and qualified reviewer.

Are you compliant yet with these four pillars? Or need help implementing in your organisation? Contact us to find out what PwC can do for you.

Contact us