A broad approach

Is the pension promise still appropriate to your pay policy? Unhappy about the administration or the costs? PwC assists employers and pension funds on all pension related issues. Our support may be engaged due to broad strategic changes or because of a specific issue or desire. We help our clients fine-tune the parameters by examining their pension schemes from various angles. We see stakeholder management as vital element in achieving change.

That little bit different

At PwC, our pension and HR advisers approach pensions from a broader perspective. And as we have nothing to gain from what is eventually decided, we can guarantee complete independence. We take a modern and broad-based approach to pension issues and, depending on what our client want, can deploy new technologies, for example in order to provide a substantiated insight into employee preferences.

Your pension scheme requires regular consideration

A pension scheme needs to be considered on a regular basis. Reasons for this include, for example, the fact that your organisation does not yet have a pension scheme or that multiple pension schemes need to be merged. Or because the pension scheme is outdated and is no longer appropriate given the entirety of your organisation's employment conditions. Our National Pension Benchmark provides insight into what the market and/or your peers are offering.

A new pension system has a major impact

The pension agreement compels every employer to consider the future pension scheme to be offered to their employees. Virtually all pension agreements will need to be adapted to the new pension system in the years ahead. There will also be many changes for pension funds and administrators. Read more about this on our website under Pension Providers.

Is your current pension provider still the best choice?

If the contract with your pension provider is nearing expiry, it's time for an evaluation. Is your provider still suitable to your (changing) workforce and company? Is your current provider able to deal with the changes in the new pension system? Is it perhaps the case that other pension providers offer lower charges and/or a better service? Or are you seeking a provider better suited to the newly agreed pension scheme?

Everything you want to know about pensions

Do you require an enhanced insight into the charges of your pension scheme? A valuation based on IAS 19 or US GAAP? How do we meet the pension requirements of an enterprise with many international employees? Pension during a merger or acquisition process: not only from a financial perspective, but certainly also from an HR point of view. Duty of care, pensions communication, ESG, legal, tax-related and compliance support. All areas for which you can rely on PwC. Not as separate stand-alone services, but delivered as a total package.

How can PwC be of service to you?

The new pension system requires that you consider four areas. And we would be pleased to support you in all of them. What can you expect from PwC?

- (Re-)design of the pension scheme

- Supporting or changing pension administration

- Supervision of the new pension system

- Management and support

- AFM license/Complaints procedure

(Re-)design of the pension scheme

- Aligning pension accrual and the pension scheme costs with an enterprise’s HR and financial policy.

- Designing and implementing a future-proof pension scheme, including its external administration with the fund, insurer or PPI

- Developing alternatives for the standard pension accrual for the executives of the enterprise.

- Developing a pension scheme that meets the (personal) wishes of the employees.

- Comparing the pension scheme with the market using our annual National Pension Benchmark

- Supervising communication to your employees surrounding the pension scheme

Supporting or changing pension administration

- Inventorying your specific wishes and criteria

- Initial selection of possible providers based on market knowledge

- Request for proposals of both qualitative and quantitative aspects

- Further selection of providers that pro-actively approach the enterprise

- Negotiations on better and stricter conditions followed by the final choice

- Support in transferring pensions accrued elsewhere to the new pension provider

Supervision of the new pension system

- Sharing with you the latest developments with regard to the new pension system and the consequences for the pension scheme

- Supporting in drawing up the required transition, communication and implementation plans

- Arranging workshops for enterprises with presentations and training courses on pensions, but which also deal more broadly with pay structure and incapacity for work

- Drawing up clear and compact reports specifically geared to the pension situation and related employee benefits

- Assistance during the entire process in order to arrive at a new pension scheme that satisfies the conditions in the new Act on pensions

Management and support

- A thorough (financial) analysis of your current pension situation

- A valuation of the pension commitment based on, for example, IAS 19 or US GAAP.

- Advice on cross-border pensions for multinationals.

- Advice during mergers and acquisitions on any effects for pension schemes.

- Support in improving communications on pensions.

AFM license/Complaints procedure

Our pensions department possesses a Wft license issued by the Netherlands Authority for the Financial Markets (AFM), which qualifies us to offer advice and support in financial (pension-related) products. Our license is listed in the AFM register under number 12040696. For more information about the advice, mediation and complaints procedure, the following documents are available.

How can we help you with our various tools?

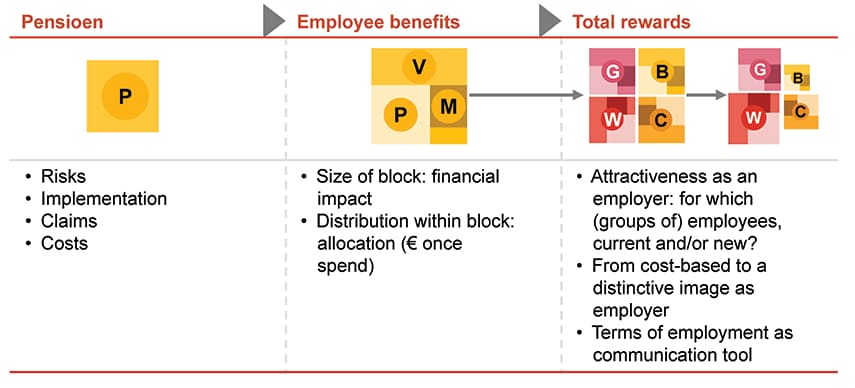

New pension system as a catalyst in the Total Rewards process

We approach pensions from a broader perspective. We take a modern and broad-based approach to pension issues and, depending on what our customers want, can deploy new technologies, for example in order to provide a substantiated insight into employee preferences. In doing so, pension and HR specialists collaborate in order to avoid a ‘pension-only’ mindset. The changes in the pension system offer the ultimate opportunity to view the pension scheme from a broader perspective.

Changes in the pension agreement and the associated compensations will impact the pension costs. It is therefore wise to start thinking about how these changes should be approached within the context of the entire employee benefits package. For example, you may want to start taking account of these changes in the pay bargaining range for salary increases.

Is too much money going towards pensions? Could we set up certain elements more flexibly? Could we possibly optimise our employees’ appreciation for the entire benefits package? These are questions that we would be pleased to tackle with you based on the total rewards proposition.

Pension as part of the total benefits package

Contact us