Repositioning, grow, results

Portfolio optimisation is an important tool to help you reposition, grow, achieve sustainable long-term results or get your business ready for sale. Reassess your overall portfolio to find out where you add the most value and where you incur costs relative to that value. Challenge yourself in terms of structure and design - 'end to end' - reinvent what work you do - how and where. Mergers and acquisitions are a powerful way to tailor your portfolio to generate both long-term value and economic resilience.

Portfolio optimisation’ triggers

As an organisation, you may be facing unprecedented changes due to the shift in global economic power, generational shifts, an aging population, the digital economy and the emergence of global players disrupting traditional industries. Internal factors can also play a role in optimising your business portfolio:

A well-planned, balanced growth portfolio

With increasing economic pressure, it is imperative that your company has a well-planned, balanced (growth) portfolio. Your short and medium term performance can improve if you assess your entire business portfolio in a number of areas:

- added value versus required investments

- long-term strategy of business units, brands and product portfolio

- strategic fit

As a company you have to challenge yourself in terms of structure and design - 'end to end' - and reinvent what you do, how and where. Identify areas of your business that may not be strategically appropriate and work to transform and divest these businesses with confidence. This allows your company to spend time and resources on the activities that best fit your portfolio.

A proactive review of the portfolio is essential. According to PwC's Divestiture Study, a comprehensive survey of more than 2,500 top executives, divestitures increase the likelihood of a positive shareholder return by 2.5 times. Proactive portfolio review involves in-depth analysis based on financial and non-financial data and analysis of the current and future competitive environment. This process helps you identify a business or part of it that doesn't fit and/or needs to be sold faster.

Active portfolio review

An active evaluation of the portfolio is necessary to remain relevant as a company. We recommend that you perform an evaluation at least annually, usually as part of your budget cycle. If your executive management is not proactive on this front, stakeholders (such as activist investors) will push your company to assess which areas no longer align with your long-term growth ambitions. The resulting divestments generate resources that you can reinvest in the optimisation of core activities or the development/acquisition of new activities/capabilities.

High interest rates make it expensive or impractical to obtain bank financing. In some cases, divestments are therefore one of the cheapest and most effective ways to raise new capital. A robust reinvestment plan in advance - knowing what the proceeds will be used for - increases the likelihood of a demerger decision being implemented.

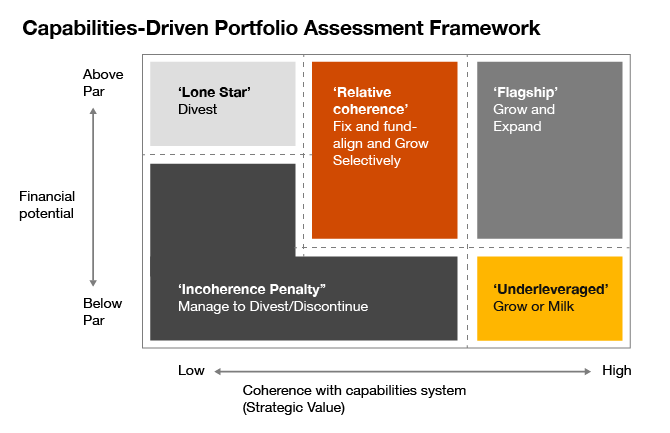

As a company, make sure you have the right combination of activities and capabilities to make confident decisions to unlock, protect and increase value while enticing potential bidders. Two elements are essential in this assessment of the portfolio: financial potential and strategic value. In general, business units that do not have a clear and coherent strategic value qualify for carve-out.