Tax Reporting & Strategy

In this rapidly changing world, PWC can help you set up a tax control system that is ready for the future. Our comprehensive approach includes the tax set-up, the associated technology and compliance. By aligning your tax function with your commercial objectives, you will immediately create a part of your strategy, from which your entire organisation will benefit.

Getting to work today on the challenges of tomorrow

Identifying the challenges, objectives and needs of your organisation is only the beginning. A successful change requires more than simply changing the output: the entire process will need to be redesigned from start to finish. PWC can guide you through the entire process and assist you in the implementation. If you want to know what it all involves, please contact us.

We can assist you with:

- Developing a tax strategy that is aligned with your business (commercial) objectives;

Assessing your current level of tax control using our Tax Maturity Model (T3M);

- The development and implementation of a detailed transformation path to bridge the gap between the current and desired level of tax compliance;

The strategic selection of IT solutions to achieve efficient and robust tax reporting processes;

Designing the process to meet (local) transparency obligations, including Country by Country Reporting;

Helping to attract, develop and retain the right skills to be "future proof" and continue to learn new skills to add value as the business and technology change.

Tax Management Maturity Model (T3M)

Tax departments are focusing more and more on how technology can be deployed to improve efficiency, robust tax processes and risk management. PwC uses the Tax Management Maturity Model (T3M) to optimally align strategy, processes, people and technology. A methodology with accompanying online tooling, which guides the organisation in a practical way to a customised Tax Control Framework (TCF) that meets the organisation's requirements and international standards.

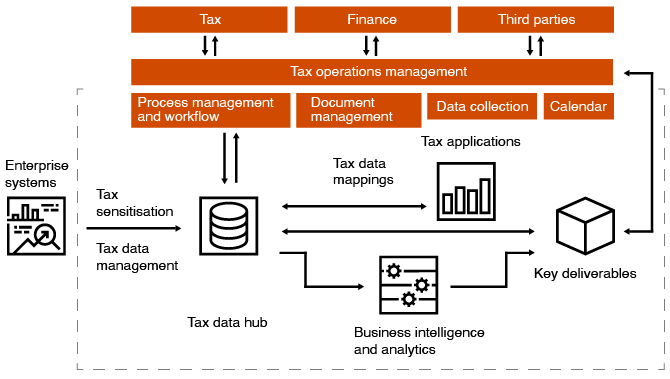

Tax technology ecosystem

Compliance

Thanks to its worldwide network of experts, PwC has wide-ranging knowledge of compliance, national and international tax rules. We are also increasingly often seeing that co-sourcing and/or outsourcing are playing an important role in the improved alignment of investments and available resources with company objectives. PwC can assist you by taking a different approach to national and international compliance rules, so that you can pursue your company objectives in an efficient manner. This does not mean technology, processes, staffing and service providers escape critical assessment. Our service provision consists of:

Coordination of all tax compliance activities (e.g. direct and indirect taxes, Tax Accounting, drawing up tax documents, documents in accordance with the articles of association and country-by-country reports). Thanks to our comprehensive approach to the various local compliance requirements, you will be able to keep transparent records.

Deployment of local country specialist teams. These teams have the experience to help you with future audits and have practical knowledge of current and future statutory provisions.

Via our web portal, Integrated Global Compliance Services (IGCS), we are able to cooperate with you anywhere in the world.

Our customer relationship managers will arrange centralised coordination and communication.

Contact us