All about the CSRD

The reporting of non-financial information is just as important in the EU as traditional financial reporting and must be of the same quality. That is the goal of the Corporate Sustainability Reporting Directive (CSRD), the EU directive that has been in effect for the largest, listed companies since fiscal year 2024.

However, the landscape of sustainability and regulation is constantly evolving. The CSRD regulations and requirements are comprehensive and very specific. Therefore, in February 2025, the European Commission presented the EU 'Omnibus Simplification Package' - a package of proposed changes that aims to reduce complexity, lower costs, and simplify requirements.

Key points of the CSRD:

- The CSRD covers sustainability in a broad sense and includes disclosure requirements for a wide range of Environmental, Social and Governance (ESG) aspects.

- For large listed companies, the CSRD will take effect as of fiscal year 2024 and thereafter will also apply to many companies not covered by the current NFRD (non-financial reporting directive).

- The EU directive requires companies to collect, process and publish a huge amount of data and information; this will require new systems, processes and a governance structure to be put in place.

- The CSRD requires an external auditor to provide assurance on sustainability reporting, initially with limited, but with reasonable assurance at a later date.

The CSRD at a glance: who, when, what and how?

The CSRD stems from the European Green Deal and its "Financing Sustainable Growth" action plan. These plans aim to transform the EU into a modern, competitive economy that works for people and delivers stability, jobs, growth and investment. The EU's goal is to become the world's first economic power to achieve net zero greenhouse gas emissions by 2050.

It is important to note that CSRD has been included in the first Omnibus Simplification Package from the European Commission (ESG Omnibus), which aims to stimulate the competitiveness of the European Union by reducing excessive burdens on companies, protecting SMEs and simplifying EU reporting and due diligence requirements.

- Who does the CSRD apply to?

- When will the CSRD take effect?

- What to report?

- How to report?

Who does the CSRD apply to?

The outgoing NFRD (Non-Financial Reporting Directive) applied only to listed companies. Under the current scope, CSRD covers all large companies that meet two of the following three criteria:

turnover exceeding €50 million per year

a balance sheet total of more than €25 million

more than 250 employees (averaged over a year)

Read more on CSRD for non-EU companies

It is estimated that eventually more than a thousand companies in the Netherlands will have to comply with the CSRD. This also applies to subsidiaries of non-EU companies. A special disclosure regime will be developed for non-EU companies that achieve (consolidated) revenue of more than €150 million in the EU.

The proposal from the European Commission on the ESG Omnibus presents changes to the criteria for entities to be in scope of CSRD:

Maintaining the requirements of turnover exceeding €50 million per year and a balance sheet total of more than €25 million

Increasing the employee threshold to more than 1,000 employees

It is important to note that these modifications are part of the Content proposal section of the Omnibus, and are subject to further changes during the legislative process.

When will the CSRD take effect?

It will be phased in for different categories of companies. The obligation to report according to the new standards will apply to:

Wave 1: companies already covered by the NFRD as of fiscal year 2024

Wave 2: large companies (see criteria above) as of fiscal year 2025

Wave 3: listed SMEs as of fiscal year 2026

Wave 4: Non-EU companies (see criteria above) as of fiscal year 2028

The European Parliament voted in early April 2025 with a large majority in favour of the 'Stop-the-clock proposal' of the ESG Omnibus. A political agreement with the Council of the European Union is expected before June 2025, with Member States having until 31 December 2025 to incorporate the amendments into national law. The anticipated changes to the timeline are as follows:

Wave 1: Timeline stays the same (companies have to keep reporting)

Wave 2: Two-year delay introduced (are in scope of FY 2027)

Wave 3: Two-year delay introduced (are in scope as of FY 2028)

- Wave 4: Timeline stays the same (are in scope as of FY 2028)

Read more here on the ESG Omnibus

What to report?

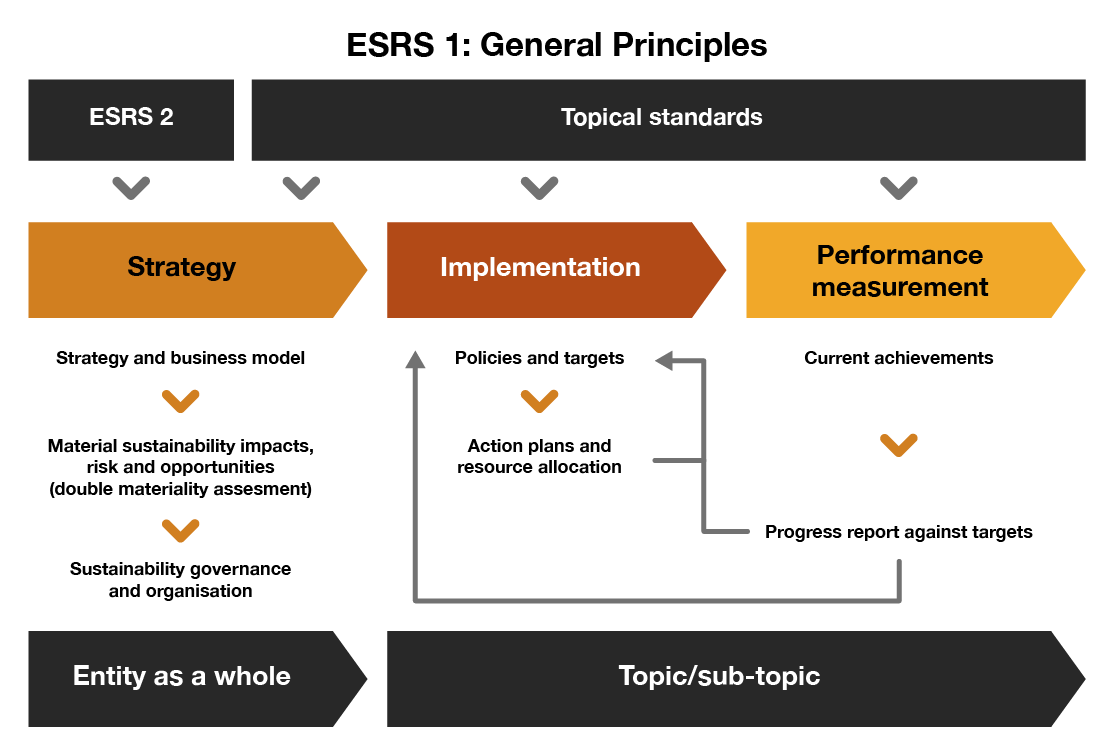

The CSRD requires companies to publish what sustainability strategy they have formulated, what targets are associated with it, what the policies and action plans and resources are allocated to achieve those targets, and how progress is monitored and reported.

How to report?

The sustainability report will become a mandatory and integral part of the annual report that must comply with a set of new reporting standards (ESRSs).

Companies must make the information available in a prescribed structure, tagged, in electronic format (XBRL) and accompanied by an assurance statement by an external auditor. These requirements are intended to increase the quality, reliability, transparency and comparability of ESG information and bring it to the same level as financial information.

ESRS standards

At the heart of the CSRD are the European Sustainability Reporting Standards (ESRSs). The first set, consisting of 12 draft standards, was submitted in late November 2022 by EFRAG to the European Commission. The European Commission has issued a revised set of ESRSs for feedback on June 9th, 2023. The revised drafts contain a number of changes compared to the November 2022 version. The aim is for the final standards to be passed as law (a Delegated Act) no later than at the end of August 2023.

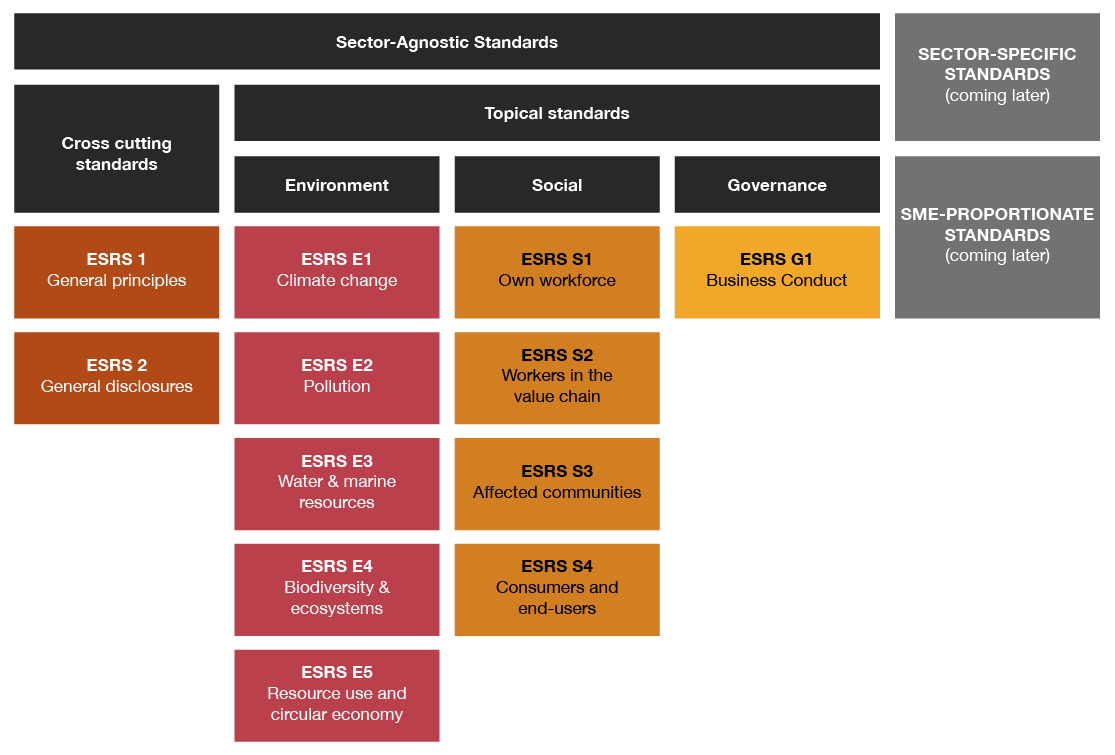

The ESRS contain 12 standards. The first two ESRSs are general in nature and contain basic principles and prescribe what should be reported on strategy, governance and decisions related to materiality. The remaining 10 standards cover different EGS aspects:

The 12 standards contain 'Disclosure Requirements' and an 'Application Guidance'. These describe exactly how the obligations should be applied; these guiding documents have the same status as the obligations and in practice represent a considerable broadening of them. Later, sector-specific standards and standards tailored to SMEs will come into effect.

A holistic narrative of sustainability

When the CSRD takes effect, companies can no longer report on their sustainability plans and performance at their own discretion. The standards create an obligation for companies to develop a holistic view of sustainability and publish about it. Users of this information should be able to create a picture of how the company is implementing sustainability, now and in the future. It is noteworthy that, unlike in its financial reporting, the company must specifically state its objectives regarding sustainability.

The sustainability narrative must answer the following questions:

- What is the role of sustainability within the corporate strategy and business model?

- What material impact does the company have on each of the ESG aspects for which a standard is set (and company-specific ESG topics not included in the ESRSs) and reversely, what impact, risks and opportunities do those same aspects bring to (the financial performance of) the company?

- How is sustainability embedded in the organizational set up and its management?

- What are the policy and objectives, action plans and available resources for each of the (material) standards?

- How does the company's current performance compare to all objectives and action plans.

What exactly must companies start reporting on?

To give a (good) impression of the reporting scope required and how specific and detailed the information provided must be, let’s look at the fourth standard under the environment theme (ESRS E4). This standard relates to biodiversity and ecosystems.

This standard contains six disclosure requirements divided into four categories

- Governance: on, among other things, the method for internal pricing of everything related to biodiversity and ecosystems.

- Strategy: on issues including the plan that leads to no net loss of biodiversity from 2030 on, and no net gain after 2050.

- Impact, risk and opportunity management: on such topics as the processes by which material risks to biodiversity and ecosystems are identified and the policies implemented to manage biodiversity and ecosystems.

- Targets and performance measures: on, among other things, the financing of projects to reduce risks and damage to biodiversity and ecosystems outside its own value chain (optional).

The CSRD requires a major leap forward in data and technology

Under the CSRD, companies will have to publish a great deal of new and very specific information. Therefore, it is clear in advance that in many companies a major leap forward is needed in their administrative organization and internal control. Where current sustainability reports may still be able to work with a spreadsheet, this will soon be insufficient.

The required amount of data increases must be qualitative and quantitative, look forward and backward, describe the short, medium and long term, and cover the entire value chain.

We expect the value chain to be the obstacle on the road to CSRD compliance for many companies. Some of the issues around data and technology that will come into play when implementing CSRD are data collection and procurement, methodology, processes and analysis, credibility and transparency, and IT systems and infrastructure and governance.

New: external auditor reviews ESG reporting

The information companies now publish on sustainability often leaves much to be desired. Relevant information is missing or incomplete, has not been created with sufficient reliability and transparency, and is often difficult to find, read and compare.

In order to raise the quality of sustainability information to the same level as financial information, the external auditor will have to provide assurance on both after the introduction of the CSRD. Initially this will be 'limited assurance', towards 2030 it will become 'reasonable assurance'.